- Already massive, accelerating data centre demand is driving unprecedented levels of demand for power capacity—potentially growing at three times the pace of the last 20 years.

- Power supply is constrained by a number of factors, including permitting timelines and equipment supply chains.

- There is a range of ways savvy developers are getting the power they need: on-site generation, co-development of power infrastructure with utilities, proactive land development and power procurement, and (to a lesser extent) moving to new markets.

Massive data centre demand is driving huge new power requirements

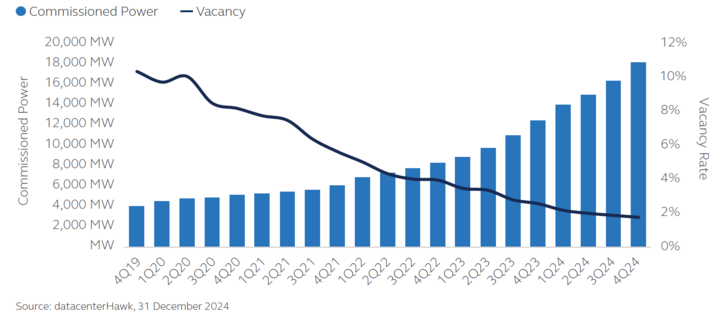

Exponential growth in demand for data centre capacity continues to accelerate— the U.S. colocation data centre market doubled in size from 2020 to 2024, and that doesn't account for all the capacity brought online by hyperscalers themselves. AI could drive demand even faster; Dell CEO Michael Dell predicts that AI will drive a 100x increase in data centre demand over the next 10 years.

Demand is rising so much faster than supply that vacancy rates in major data centre markets are at their lowest levels ever—below 3% nationwide.

Data centre supply is growing, but not as fast as demand

The primary task of a data centre is to securely house, power, and cool the IT equipment on which virtually every aspect of modern life depends. Challenges abound: land is constrained in some markets, and data centre operators are having to adopt new cooling strategies to support AI. But power is the predominant gating factor in data centre developers' ability to support growing demand.

Data centre power demand was already growing rapidly, but generative AI has driven it to unprecedented rates. That is in part because these AI models are incredibly power-intensive—before generative AI, computational requirements grew about 8x every two years, now it's 256x. Another factor is how widespread generative AI has become, with applications like ChatGPT making it accessible to anyone with an internet connection.

In aggregate, demand for power in the U.S. could grow 15.8% over the next five years, according to a December 2024 report by the power sector analyst firm Grid Strategies.1 (The official forecast is 8.2%, but new updates suggest much higher growth.) Data centres are the primary driver, though manufacturing and electrification are also adding significant new demand.

Delivery of new power constrained by lack of transmission capacity

Average load growth has been well below 1% per year for the last two decades. A 3% annual growth rate would require six times the planning and construction of new generation and transmission capacity than utilities are used to. Now, "connection requests for hyperscale facilities of 300-1000MW or larger with lead times of 1-3 years are stretching the capacity of local grids to deliver and supply power at that pace."2

The issue, for now at least, is not a lack of generating capacity. Rather, it's the speed (or lack thereof) with which utilities can build new transmission lines to get the power to the new data centres. Permitting is a significant constraint. According to analysis by Lawrence Berkeley National Laboratory, "the timeline from the initial connection request to having a fully built and operational plant has increased from under two years for projects built in 2000- 2007 to more than four years for those built in 2018-2023."3

Supply chain delays for critical equipment is another constraint on utilities' ability to fulfil interconnection requests. According to CBRE, "Power delivery timelines will continue to increase in H2 2024 due to a shortage of readily available equipment, such as transformers, switches and generators. Difficulty in procuring critical equipment will lead to power delivery delays of up to four years."4

What's a data centre developer to do?

The combination of massive power requirements and constraints on utilities' ability to deliver new capacity quickly makes the data centre development process more difficult, and longer. Gartner predicts "40% of existing AI data centres will be operationally constrained by power availability by 2027."5 For many investors, this begs the question: How are data centre developers meeting demand?

There are a range of ways savvy data centre developers—hyperscalers themselves, as well as third-party providers—are getting the power they need: through on-site generation, co-development of power infrastructure with utilities, proactive land development and power procurement, and (to a lesser extent) by looking to new markets.

Conclusion: Investor considerations

Data centre developers face a ‘perfect storm': massive (and accelerating) demand for data centre capacity, driving unprecedented rates of demand for power, in an environment in which getting power to the data centre takes twice as long as before. Not all developers are equally well-equipped to navigate these challenges. For investors, realizing the full return potential requires a keen understanding of which developers are poised to be able to deliver more data centre capacity, more quickly than others.

Discover the ways data centre developers are getting the power they need

1The report's load growth estimates are based on annual planning reports submitted to the Federal Energy Regulatory Commission by electric balancing authorities, and updated with additional data from utilities and planning regions. Source: Grid Strategies, Strategic Industries Surging: Driving US Power Demand, December 2024.

2U.S. Department of Energy, Recommendations on Powering Artificial Intelligence and Data Center Infrastructure, 30 July 2024.

3Lawrence Berkeley National Laboratory, Grid connection backlog grows by 30% in 2023, 10 Apr 2024.

4CBRE, North America Data Center Trends H1 2024, 19 Aug 2024.

5Gartner, Rapid Growth in Energy Consumption For GenAI Will Exceed Power Utilities' Capacity, 12 Nov 2024.

Investing involves risk, including possible loss of principal. Past Performance does not guarantee future return.

Potential investors should be aware of the risks inherent to owning and investing in real estate, including value fluctuations, capital market pricing volatility, liquidity risks, leverage, credit risk, occupancy risk and legal risk. All these risks can lead to a decline in the value of the real estate, a decline in the income produced by the real estate and declines in the value or total loss in value of securities derived from investments in real estate.