Stuart Taylor says deficit reduction could also lead to significant rerating of DB insurers

Something powerful is happening across corporate UK and it is almost entirely hidden from view.

It is well known that many companies have defined benefit pension schemes - some huge, even though most are now closed to new members. As has been well-documented over many years, lots have been underfunded, with large deficits requiring seemingly endless top-up payments from the sponsoring companies. However, today those deficits have largely vanished.

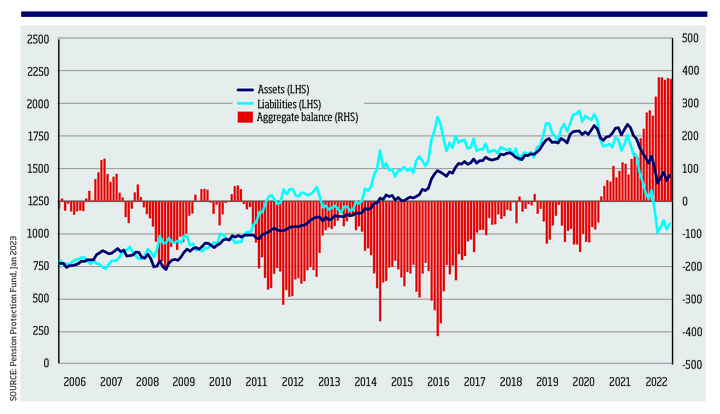

UK pension deficits

The Pension Protection Fund tracks more than 5,000 defined benefit pension schemes, producing a monthly index giving their estimated funding position. Historically, most pension schemes have been in deficit, with 88% of them having a shortfall at the worst point during 2009. As at the end of January 2023 the proportion had fallen to less than 14%, with an aggregate surplus of £374.4bn.

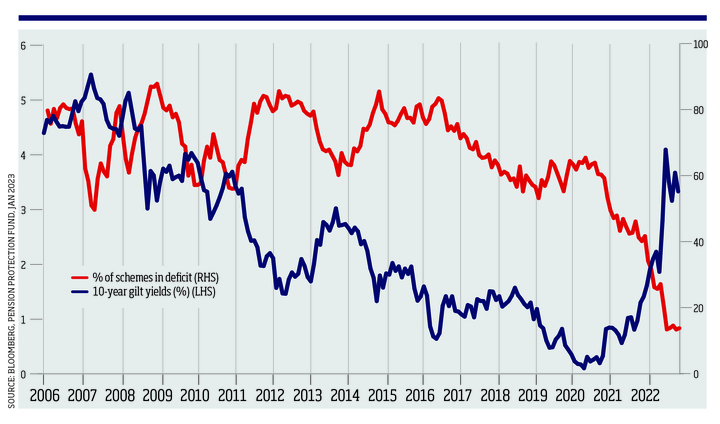

Pension top-up payments have undoubtedly helped improve the funding position but most of the work has been done by the increase in bond yields which have reduced the present value of the scheme liabilities.

UK gilt yields and pension deficits

A real-world example can be seen with BAE Systems, which suffered for many years with a large pension deficit. Although as recently as 2020 its UK scheme was in a £4.3bn deficit, by the middle of 2022 it had been transformed into a £1.5bn surplus.

Between 2017 and 2021 BAE systems paid almost £2bn in top-up payments to the UK scheme. These are cash flows that could otherwise have been invested to create an economic return or paid back to shareholders. If this and schemes like it can be permanently funded, then endless top-ups will be a thing of the past and more cash can flow to shareholders.

An opportunity has therefore been created for many corporates to fix their pension problem permanently. Given the three-year cycle of formally valuing pension schemes, this might be a slow process, but we believe that there is little doubt about how keen UK finance directors are to cure this headache.

What is the solution?

The UK market for de-risking pension schemes has been gathering momentum: growth is forecast to accelerate, with £30-50bn of pension liabilities per annum expected to be transferred to insurance companies over the next four to five years.

It is estimated that as at the end of 2021 only 10% of UK defined benefit liabilities had been de-risked, creating a huge potential pipeline of business for UK life insurers. There are only a handful of UK operators in this market and about half of them are listed companies. The low valuation of the listed players suggests they are quite unloved by the market and could be due a significant rerating as more light is shone on this opportunity.

For example, one of the largest players, Legal & General, is trading at PE ratio of 7.5x and dividend yield of around 7.5% while having well over 200% of its required regulatory capital.

Many UK investors shun life assurance companies because they view them as impenetrable ‘black boxes' and avoid companies with large pension liabilities because they are ‘black holes'. This is the opportunity,.

Stuart Taylor is senior fund manager for UK equities at Canada Life Asset Management

This article was originally published by PP's sister title, Investment Week.