Dan Mikulskis

Defined Contribution

70% of default accumulations will be aligned to Paris Agreement goal of 1.5 °C by 2030

Defined Contribution

Charlotte Moore speaks to People’s Partnership’s CIO Dan Mikulskis

Appointments

PP brings together all the appointments in the pensions industry over the past week

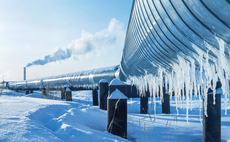

Investment

Risks such as climate change and biodiversity loss pose ‘real threats’ to scheme investments

Law and Regulation

Statement from key EEA regulators sets clear expectations for resilience of LDI portfolios

Investment

Charlotte Moore says the path forward will vary depending on scheme circumstances

Investment

PP speaks to trustees and consultants about the liquidity squeeze and what could happen next

Defined Contribution

New research paper highlights the benefits and drawbacks of consolidation

Investment

Charlotte Moore looks at how trustees are now viewing sectors such as energy and defence

Defined Contribution

Ignoring the ‘pensions Cinderella’ will return to haunt us, says Stephanie Hawthorne