Global stock markets have staged a remarkable recovery from their lows in late March, despite recent volatility. This rebound, however, has not been even. In the U.S., large‑cap stocks have led the way. In particular, some of the marquee growth stocks have enjoyed the best of the returns as the market has recognized that certain companies would see their economic futures pulled forward by the disruption created by the coronavirus crisis. Unusually, growth stocks have showed market leadership before, during, and after a market crisis, albeit supported by greatly superior sales, earnings, and cash flow characteristics (see chart).

Why Small-Caps Can Punch Above Their Weight

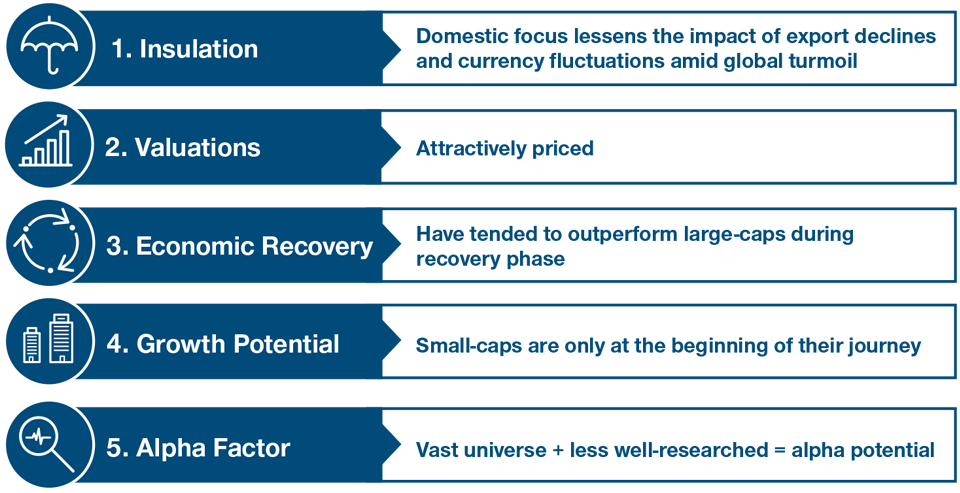

By contrast, U.S. small‑cap stocks, as measured by the Russell 2000 Index, have performed poorly. It seems that in some cases the stock market recovery has eluded smaller companies. Empirical evidence, however, reflects that small‑caps historically outperform large‑caps over longer time periods. We have identified five potential drivers that could contribute to a reversal of small‑caps' recent underperformance.

…the stock market recovery has eluded smaller companies.- Yoram Lustig, Head of EMEA Multi‑Asset Solutions

1. Better Immunization to Global Turmoil

Undeniably, the world faces major challenges right now. The coronavirus pandemic has decimated economic growth, with many economies remaining in deep recession as lockdown measures and disruption to global supply chains have impacted trade and services. Rising geopolitical tensions are also factors. China and the U.S. remain entrenched in a divisive trade war, and the rhetoric is heating up as we approach November's U.S. presidential election. Meanwhile, with the U.S. economy faltering, the Federal Reserve has had to slash interest rates to near zero to support growth, putting pressure on the U.S. dollar.

But turmoil in the global economy and currency markets has more of an impact on companies that rely more heavily on exports. Small‑caps, on the other hand, typically focus on local markets to sell their produce and services, making them more immune to currency fluctuations and global economic turbulence relative to large‑caps.

Important Information

For professional clients only. Not for further distribution.

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, and prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

This material is issued and approved by T. Rowe Price International Ltd, 60 Queen Victoria Street, London, EC4N 4TZ which is authorised and regulated by the UK Financial Conduct Authority. For Professional Clients only.

© 2020 T. Rowe Price. All rights reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the bighorn sheep design are, collectively and/or apart, trademarks or registered trademarks of T. Rowe Price Group, Inc.