Amid the tumultuous market environment of 2020, as virtually every country grappled with the unprecedented coronavirus pandemic, another important investment movement was emerging from a tragedy of a different kind.

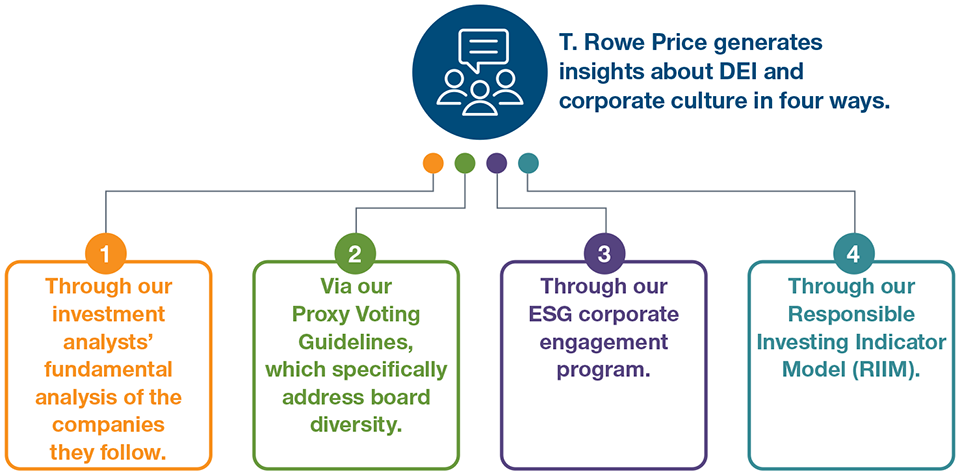

Generating Insights on DEI and Corporate Culture

(Fig. 1) A lack of comprehensive and comparable data is an ongoing challenge

Source: T. Rowe Price.

The interest of investors and other stakeholders in diversity, equity, and inclusion (DEI) exploded following the tragic death of George Floyd at the hands of Minneapolis police in May 2020. An extended period of protests against racial injustice followed, both across the U.S. and in cities around the world. These incidents prompted many of us as individuals to examine how we could promote positive change in our own lives, but they also caused corporations to examine their links to systemic racism and explore ways to change these persistent, destructive patterns. Corporations were responding to a variety of stakeholders as they undertook this analysis: their employees, investors, communities, potential future employees, and boards of directors. Often, corporate leaders felt it was an important moment to speak out.

In this paper, we describe the ways that DEI intersects with investment decision‑making at T. Rowe Price. We also share what we learned in 2020 after speaking with hundreds of companies about their perspectives and actions to create truly inclusive and representative workplaces.

Important Information

For professional clients only. Not for further distribution.

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, and prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

This material is issued and approved by T. Rowe Price International Ltd, 60 Queen Victoria Street, London, EC4N 4TZ which is authorised and regulated by the UK Financial Conduct Authority. For Professional Clients only.

© 2021 T. Rowe Price. All rights reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the bighorn sheep design are, collectively and/or apart, trademarks or registered trademarks of T. Rowe Price Group, Inc.