One year ago, heading into the 2020-21 winter resurgence of COVID-19, we identified two themes to define the coming year for private credit. First, we believed temporary disruption would not mean value destruction. Second, we believed that defaults were delayed (not done).

Once prescient, these themes are now present. As consumers and investors continue to reinvent themselves, the economy - and the real estate and infrastructure that undergird it - are transforming to meet the needs of an ever-evolving "new normal."

What does this mean for private credit investing? What were considered disruptive startup and early-stage companies two years ago have grown into middle market corporations that seek lenders to help finance their growth and acquisitions.

Real estate investing continues to transform, embracing greater work flexibility, data centers, infill and what appears to be an insatiable demand for online shopping and the distribution, storage and transport it requires.

Infrastructure investment is seizing opportunities in the accelerating transition from traditional energy to alternative fuels as consumers demand sustainability in goods, services and spaces.

We see growth in private credit supply and demand - and ample opportunity - ahead. On the supply side, borrowers continue to look to the private markets due to its relatively greater speed and certainty of execution, after many were burned by public markets and banks pulling back capital during more uncertain times. Equally, borrowers value the adaptability and partnership of private lenders, often the only - or the lead - investor in deals.

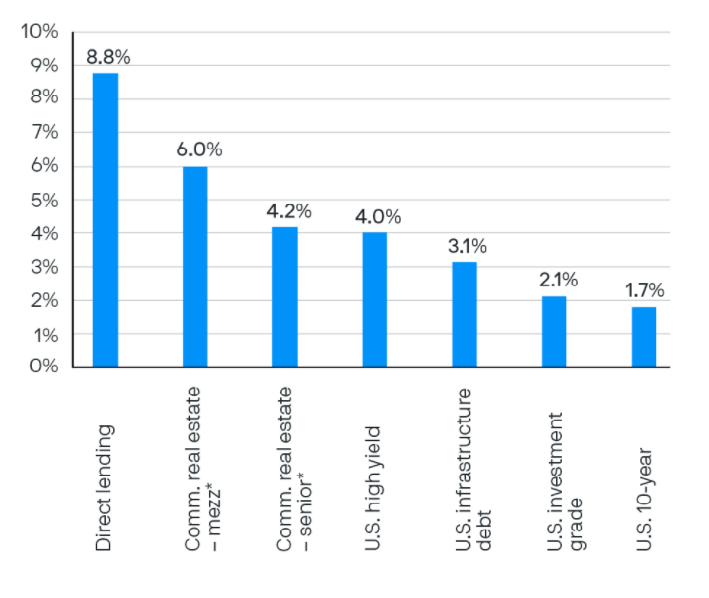

On the demand side, the global search for yield continues but today also includes a demand for assets that can hedge inflation and protect capital in still-unknown market environments. As a result, investors are increasing their allocations to private credit. It still offers relatively high spreads over public markets (Exhibit 1), covenants (lender protection), and floating rate or asset-based inflation protection, and it will likely continue to exhibit low volatility due to its less liquid nature.

As the global search for yield continues, investors are increasing their allocations to private credit, which still offers relatively high yields over public markets

Exhibit 1: Asset class yields (%)

Source: BofA Securities, Bloomberg, Clarkson, Cliffwater, Drewry Maritime Consultants, Federal Reserve, FTSE, MSCI, NCREIF, FactSet, Wells Fargo, J.P. Morgan Asset Management. *Commercial real estate (CRE) yields are as of September 30, 2021. CRE - mezzanine yield is derived from a J.P. Morgan survey and U.S. Treasuries of a similar duration. CRE - senior yield is sourced from the Gilberto-Levy Performance Aggregate Index (unlevered); U.S. high yield: Bloomberg US Aggregate Credit - Corporate - High Yield; U.S. infrastructure debt: iBoxx USD Infrastructure Index capturing USD infrastructure debt bond issuance over USD 500 million; U.S. 10-year: Bloomberg U.S. 10-year Treasury yield; U.S. investment grade: Bloomberg U.S. Corporate Investment Grade.

This post was funded by J.P.Morgan Asset Management