Sovereign bonds are a major component of the fixed income market. They represent the largest single group within the fixed income investment universe and therefore the largest share of global assets under management. Within the Bloomberg Global Aggregate index, for example, Treasuries and sovereign bonds represent nearly 54% of market value.1 Agency, local authority and supranational issuers account for a further 9%, 3% and 2% of market value, respectively. By comparison, industrial bond issuers account for just 10% of this index. Other major indices are not too different: In the Bloomberg Pan-Euro Aggregate index, Treasuries and sovereign bonds represent nearly 61% of market value, and agencies, supranational and local authorities' bonds account for an additional 15%.

The world of sovereign issuers is often divided into emerging markets (EM) and developed markets (DM). This division reflects, among other things, the riskiness of the issuer and the type of analysis undertaken by investors. DM sovereign bonds are the focus of this paper. These bonds have historically been viewed as having relatively low credit risk, especially those issued by large countries such as the US and Germany. The credit quality of many developed market sovereign issuers has deteriorated over the past two decades, however, as public sector borrowing has risen in almost every country. The deterioration has led the credit rating agencies to downgrade many DM sovereigns.

For example, until 2013 the United Kingdom was rated Aaa by Moody's, but since then its rating has declined to Aa3. In 2001, Spain's rating was raised to Aaa by Moody's, but in 2012 in the wake of the Eurozone debt crisis, it was downgraded to Baa3 (the lowest investment-grade rating); although it has recovered since then to Baa1, it is still a far cry from a triple-A rating. The most noteworthy recent example among DM sovereigns is Greece, which was upgraded to A1 by Moody's in 2002 and then, following the GFC and the Eurozone debt crisis, downgraded several times: to A3 in April 2010, to Ba1 (sub-investment grade) in June 2010 and to C in March 2012. In a reversal of fortune, Greece's credit rating improved to Ba3 in November 2020.

The importance of integrating ESG into sovereign debt analysis

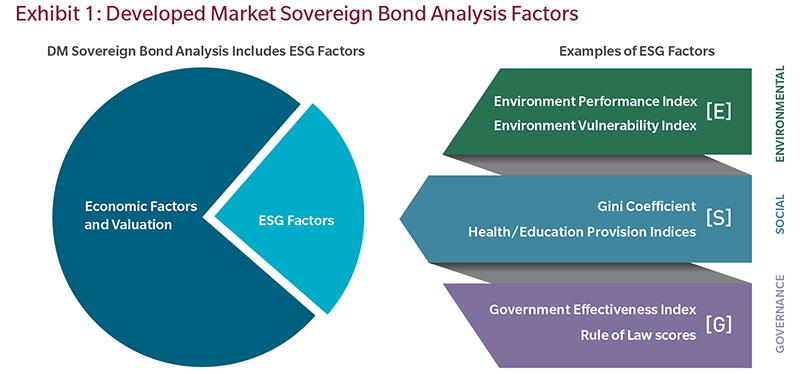

During the Eurozone debt crisis, bonds issued by Greece, Ireland, Italy, Portugal and Spain experienced much higher volatility than anticipated, leading investors to place greater importance on thorough analysis, including areas related to ESG factors. While it is true that considering some ESG factors has been an integral part of sovereign bond analysis for many years, the explicit integration of these factors is still in its relative infancy. Historically, DM sovereign bond analysis has considered factors such as population profile, stability and policy of governments, and labour market structure as part of the macroeconomic and fiscal analysis of the issuer. This has been combined with valuation considerations to result in an investment decision. In recent years, there has been an increased focus on integrating the consideration of ESG factors into DM sovereign debt analysis more explicitly because of the experience of the Eurozone debt crisis and other reasons.

The impetus for explicit ESG inclusion in DM sovereign analysis can be categorised into three broad areas:

- Seeking to improve investment performance — With the increasing effects of climate change on countries' economies around the globe, focusing solely on macroeconomic and fiscal data indicators can lead to suboptimal investment decisions. Greater awareness of the impact of climate change as well as social factors on the performance of DM sovereign bonds is driving investors to seek additional factors for consideration. Independent research suggests ESG scores have been drivers of sovereign credit spreads; countries with high social and governance scores in particular have tended to have tighter credit spreads. The relationship between ESG scores and credit spreads is especially strong in EM where there is additional risk premium relative to DM.2

- Investor demand — Asset owners' desire to address climate change as well as the social and governance aspects of their portfolios, alongside increased awareness of the potential performance implications of these factors, has further driven the explicit integration of the consideration of ESG factors into investment analysis.

- Regulation — Regulatory bodies are increasingly emphasising the disclosure of ESG factors as it relates to both the research process (e.g., integration of ESG considerations in identifying investments and portfolio construction) and product development and marketing (e.g., investment product categories).

The above factors, among others, make it challenging to accurately use the one-size-fits-all approach most ESG ratings providers employ when evaluating securities or funds. As a result, many ESG ratings providers disagree with each other on their views of certain companies.

Barriers to integrating ESG

While the drivers of the further integration of ESG into sovereign debt analysis are known, there are also some very significant barriers to the approach gaining traction.

This post was funded by MFS