Key points

- Private equity’s valuation reset will separate low- and high-quality companies.

- PE secondaries are no longer niche and should not be overlooked.

- Private debt is hardwired for the hard times ahead.

- Private real estate markets are just beginning a major remodel.

- Energy, food, and decentralized technologies will bring the next wave of opportunities.

The end of the easy money era requires new approaches to private market investing. In Franklin Templeton's new report, they reveal the key risks and opportunities across asset classes and some considerations to prosper in this new market landscape.

2023 marks the next evolution for private markets, characterized by challenges and opportunities. Higher interest rates and a shrinking Federal Reserve balance sheet are lowering liquidity in capital markets, creating financial headwinds across all major asset classes.

Looking across private markets, we believe there are opportunities in select asset classes that look more attractive today than they have been in more than a decade. In our new report, we outline the key risks, opportunities, and portfolio implications investors need to know to thrive in the new environment.

Private equity: paused, awaiting a reset

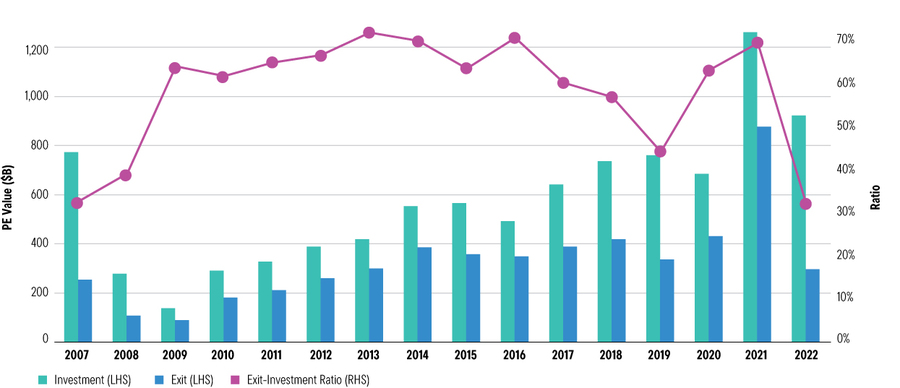

The private equity (PE) market reached an inflection point in 2022 as the idyllic era of declining interest rates and ever-growing valuations came to an end. At the end of 2022, the exit-to-investment ratio stood at less than 0.40x, the lowest figure since the global financial crisis.

Exit environment drops to 15-year low

PE investment and exit deal value; exit/investment ratio

Source: PitchBook, as of 12/31/22. This ratio tracks the value of PE exits in any given period against PE investments, excluding addons.

Investment implications

We believe exits will remain low in 2023, potentially leading to a real reset in valuations. Lower tier companies in their industries are likely to see the largest reductions, while top tier industry leaders that are well-managed and well-capitalized should weather the storm better.

PE secondaries: no longer niche

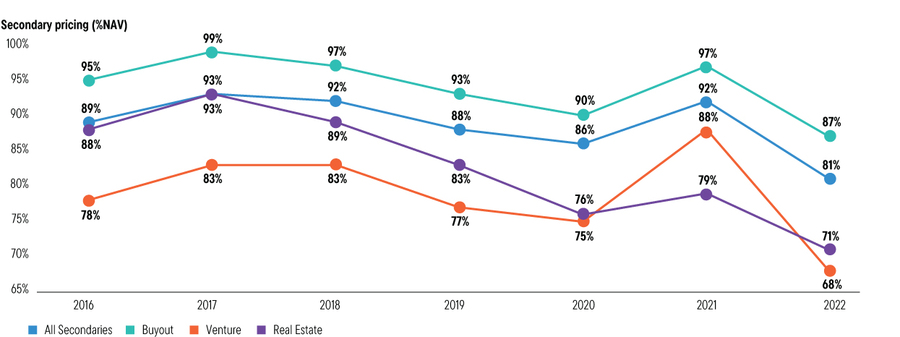

It appears that 2023 will be a pivotal year for private equity allocators to take advantage of the growing secondaries market. Today, secondaries markets have evolved and deepened substantially with more than $100 billion in estimated volume in 2022 alone.1 This emerging marketplace provides an alternative to investing purely in primary fundraises.

Looking ahead, several factors are poised to favour buyers of secondaries, including low levels of dry powder on the sidelines and more LPs seeking liquidity as they reconfigure their private capital allocations.

Secondaries discount largest in 7+ years

Secondary pricing for LP portfolios (% NAV)

Source: Jefferies Global Secondary Market Review. Transaction pricing data is sourced from Preqin database and is self-reported and/or gathered from industry professionals including fund managers, investors, and service providers. As of January 2023.

Investment implications

We are seeing a lopsided secondaries market that will likely heavily favour investors on the buying side of the negotiating table. From a risk/reward perspective, we believe 2023 will be a year to remember for secondary market opportunities.

Private debt: hardwired for hard times

Just a year ago, private debt was maligned with a number of factors that presented an uninspiring risk/return profile, including tight spreads to public debt, "covenant-lite" loans, and substantial competition for deals. Yet, investors continued making allocations given the lack of yield available elsewhere.

Today, the asset class presents a far different picture and shows how this segment is essentially "hardwired" for a rising rate, risk-off market environment where traditional financing is shutdown. Now, private lenders have much greater negotiating power and can extract a complexity premium and build in better default protections. Tough economic environments may lead to greater dispersion in manager returns—challenging the idea that the direct lending space has become commoditized.

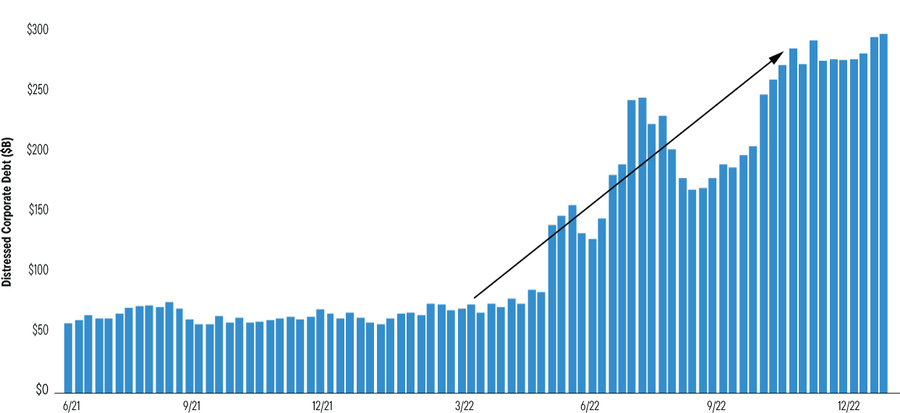

Size of distressed debt market up +400%

Value of US corporate bonds and loans trading at distressed levels

Source: Bloomberg, as of 12/31/22. Note: Dollar-denominated corporate bonds and loans in the Americas trading at distressed levels includes corporate bonds trading at spreads greater than 1,000 basis points and loans trading below 80 cents on the dollar.

Investment implications

Direct lenders with experienced workout teams and solutions-based approaches are ready to combat higher default risks. At the same time, there is an opportunity set explosion within the distressed space with more and more "good company, bad balance sheet" investments offering attractive potential returns.

Private real estate: Remodeling for rising rates

The combination of higher inflation and rising interest rates will likely have a material yet varied impact on the real estate market in 2023. Higher financing costs along with tighter lending standards have added some upward pressure on capitalization rates and downward pressure on property values.

Real estate portfolios need a remodel. Post-pandemic trends like remote work, e-commerce growth, and the migration of people to non-traditional urban business centres are reshuffling property markets. While we believe yields will continue to soften, we expect further bifurcation—well located, sustainable, long-term let or reversionary assets will attract significant investor interest, and older assets with obsolescence risk in unfavoured sectors will suffer disproportionately.

Investment implications

As the market leaders and laggards reshuffle, higher inflation and rising interest rates will h ave material yet varied impacts on private real estate. Opportunistic investors may be able to acquire high-quality assets at a discount—and at scale—in sectors with secular tailwinds.

Learn about the evolving private markets landscape, detailed asset class outlooks, and the technological trends driving the next generation of investment opportunities.