Three key trends are emerging from today's higher funding levels as schemes increasingly seek to ‘bridge’ the gap to their endgame. Amid higher funding levels, trustee focus has moved towards long-term funding targets. These include buyout with an insurer, running on the scheme while generating a surplus, and other endgame solutions. With this backdrop in mind, we expect hot topics for 2024 to include the following areas: a resurgence of CDI or ‘integrated matching solutions’, the search for solutions to illiquidity, and focus on investing like an insurer.

1. A resurgence of CDI or ‘integrated matching solutions'

Given potential regulatory reform following last year's Mansion House speech and Autumn Statement, trustees and sponsors may consider options to run-on their scheme and generate surplus, and delay a potential buyout while liabilities mature and reduce in size.

Cue a renewed interest in CDI, or cashflow-driven investment-based investment strategies to pay pensions, manage risks and generate surplus, where a key investment choice will be to allocate to credit or other cashflow-generating assets.

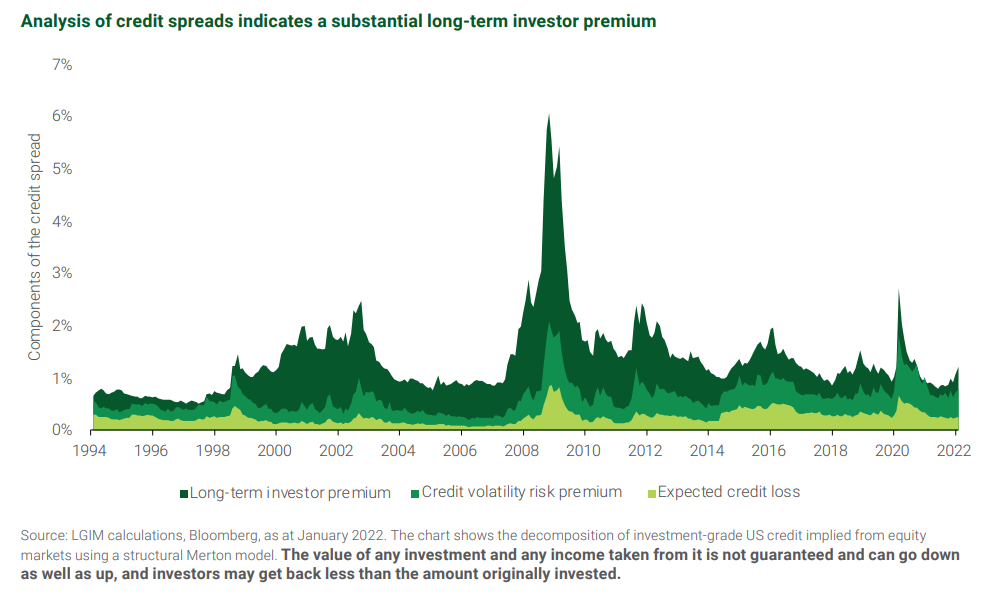

Why? To capture the ‘long-term investor premium' i.e. the observable effect that the spread earned on corporate bonds tends to be considerably wider than can be explained by (1) expected credit losses from downgrades and defaults and (2) uncertainty in those losses (which we call a credit volatility risk premium).

This premium can be viewed as compensation for price volatility arising from spread movements, and lower liquidity given corporate bonds are more expensive to trade than gilts. Both factors will be legitimate concerns for a short-term investor, but neither should matter much for investors with a longer time horizon, in our view.

Consequently, we expect schemes targeting run-on to consider investing in an integrated credit and LDI (liability-driven investment) cashflow-matching solution, to ‘invest like an insurer', but with the benefit of ‘being a pension fund' and investing in assets that insurers tend to not invest in, potentially including certain illiquid assets and a diversifying[1] allocation to equities and alternatives.

2. The search for solutions to illiquidity

For those schemes that have buyout in their near-term horizon, what to do with illiquid assets was a conundrum for many during 2023. Thankfully, the investment and insurance market has been innovating to help trustees find liquidity for these illiquid assets and we expect more schemes to appraise this in 2024.

How? With enough time, trustees can manage down their illiquid assets alongside LDI and credit portfolios, by awaiting redemptions or a return of capital, and managing overall portfolio liquidity carefully in the intervening period. If a faster resolution is required, trustees can consider secondary market sales of their illiquid holdings. We offer investment management solutions to run-off and restructure illiquid assets in this way to create liquid portfolios as part of a wider credit and LDI mandate.

However, if buyout affordability and readiness accelerate on the horizon, potential insurance solutions exist too. For instance, Legal & General offer a range of illiquid asset solutions as part of their buy-in and buyout proposition where Legal & General can finance assets (through a deferred premium) while the trustee completes its restructure or purchase assets (to hold or for a later sale) and that aims to provide certainty to complete a transaction.

3. Focus on investing like an insurer

Finally, for those schemes that are well enough funded to buyout (or soon will be), then while they prepare for the buyout process (e.g. in terms of setting up governance structure, advisers, preparing data and defining key success criteria for selecting an insurer), a key consideration will be to maintain (or improve) their buyout funding level.

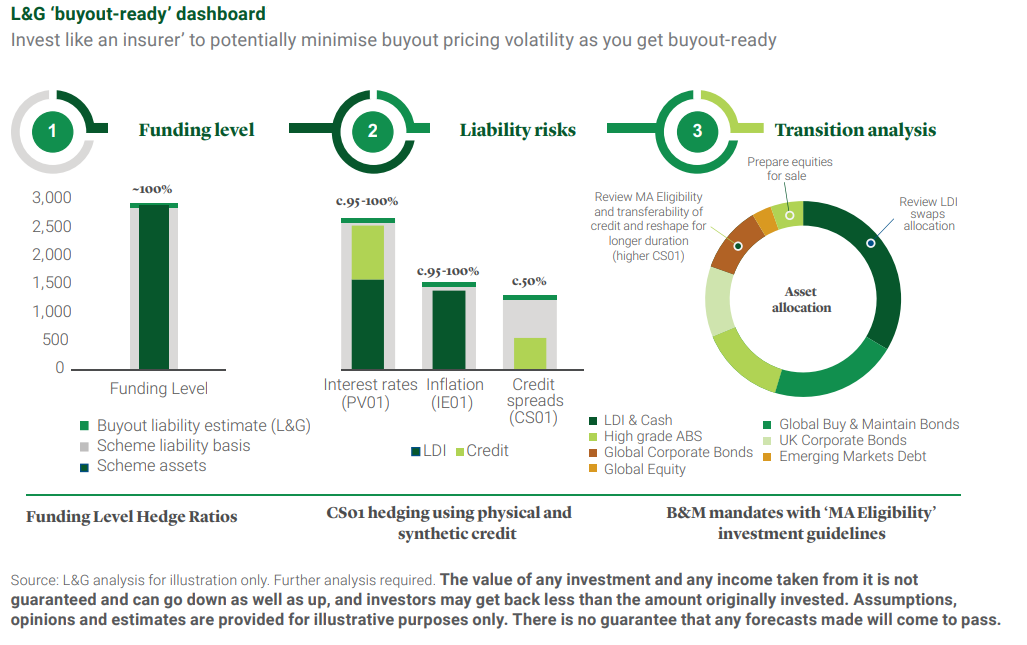

Critical to this is ensuring that the scheme's investment risk profile is aligned with the pricing sensitivity for changes in buyout pricing. This can be done by ‘investing like an insurer', in an integrated credit and LDI investment strategy with appropriate ‘hedge ratios' to interest rates (PV01), inflation (IE01) and credit spreads (CS01).

While hedging PV01 and IE01 in LDI is mainstream, clients are now looking to add CS01 hedge ratio monitoring to their credit and LDI mandates to seek to better align their risk profiles for an endgame of buyout.

We have been helping clients potentially consider this approach further via a buyout-aware dashboard[2] that considers funding level, liability risks and transferability for buyout and we expect more clients to examine this in 2024.

The above is an extract from our 2024 Solutions outlook.

[1] It should be noted that diversification is no guarantee against a loss in a declining market

[2] (1) Buyout funding level is estimated for the Scheme liability duration compared to the L&G Affordability Index, an index that gives a first order indication of L&G's typical level of pricing at a point in time and compared to the total value of all assets provided by the Scheme. (2) CS01 is the change in value of a liability or asset for a 1bps change in the credit spread of the relevant yield curve, calculated by LGIM. For buyout liabilities for this illustrative Scheme, this is assumed to be equal to 50% of the liability PV01 on a buyout liability basis. (3) Matching Adjustment calculated under licence from Legal & General and reflects assets that can be held by an insurance company to back a Solvency II matching adjustment eligible annuity portfolio.

Read at LGIM Blog: Future themes for well-funded schemes

Mathew Webb is Head of Endgame Solutions at LGIM