As real estate markets continue to evolve, investors can capitalize on the growing demand for social infrastructure assets. We believe the current environment provides an attractive entry point to investments that can provide long-term stable cash flow. By embracing a finance-first impact investment approach – where both market-rate returns and impact are targeted - investors can contribute to positive social and environmental outcomes while achieving their financial objectives.

Social infrastructure: essential for a brighter future

Following recent headwinds, many of real estate's toughest challenges are likely in the rearview mirror. As such, we believe that the current environment offers investors a chance to capitalize on emerging trends. Amidst these shifts, one sector stands out – social infrastructure. We define social infrastructure as real estate that maintains and strengthens social services, that includes sub-sectors like healthcare, education, housing, and justice & emergency amongst others. It intersects with several emerging trends, including demographic change, housing shortages, and sustainability. As governments worldwide struggle to address funding shortfalls, the private sector has a unique opportunity to invest in assets that fulfil society's fundamental needs.

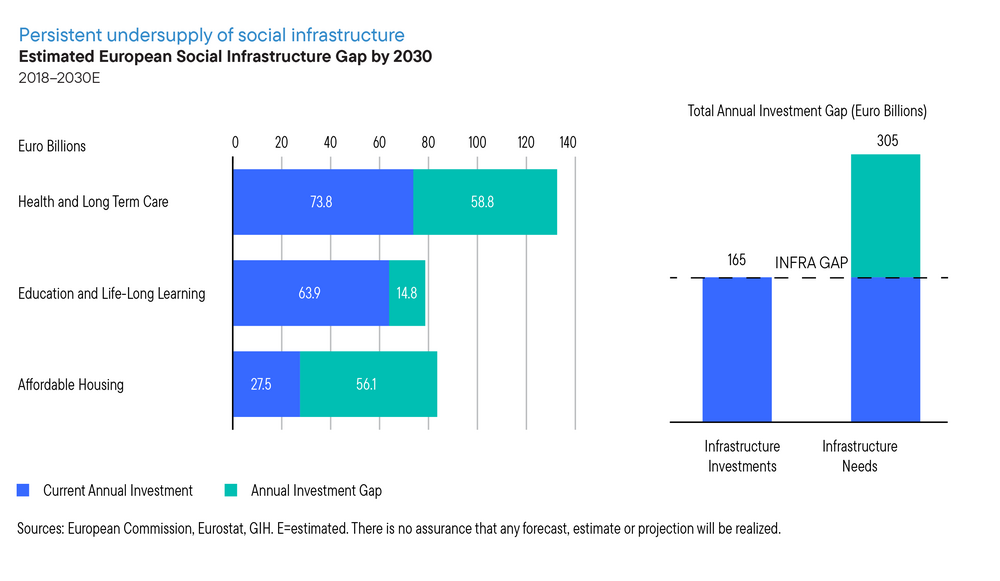

Demand for social infrastructure consistently outpaces supply, setting it apart from other real estate sectors such as office, retail or hospitality. Its essential nature ensures resilience throughout economic cycles, making it historically less volatile and more resilient. Furthermore, a persistent investment gap in social infrastructure, as illustrated in the chart below, indicates minimal risk of oversupply. Consequently, social infrastructure investments may exhibit lower sensitivity to fluctuations in real estate pricing.

Creating meaningful impact

Beyond the potential financial benefits, social infrastructure offers impact investors a unique opportunity to make a tangible impact, whether by enhancing social value or fighting climate change. Investing in social infrastructure directly contributes to several of the United Nations' Sustainable Development Goals, such as ensuring access to quality education, healthcare, and affordable housing.

As real estate investors, we look to respond to these social and environmental challenges through the development of dedicated impact investing strategies focusing on social infrastructure in Europe. We believe that impact investing should be anchored in three pillars.

1. Intentionality: explicitly targeting specific social or environmental outcomes such as the UN Sustainable Development Goals.

2. Contribution: playing a differentiated role to enhance the achievement of the targeted social or environmental outcomes.

3. Measurement: monitoring and reporting impact performance based on measurable inputs, outputs, and outcomes.

Examples of how financially sound investments in social infrastructure can directly contribute to social and environmental goals are multiple. For instance, in Ireland, where the demand for affordable housing is high, we backed the development of 157 units in Dublin and leased them over the long term to the municipality. These units provide subsidized, long-term accommodation for families at rents that are more than 80% below market value, offering a lifeline to families who otherwise might struggle to afford housing while also providing stable, long-term income for investors.

Furthermore, social infrastructure presents investors with an opportunity to combat climate change. By signing long-term leases with social service operators, investors can unlock opportunities to implement environmentally sustainable practices that benefit both tenants and landlords. These initiatives extend beyond what would typically be addressed in a traditional tenant-landlord relationship, offering a path toward meaningful environmental impact.

Seizing opportunity: investing at an attractive entry point

While investing in social infrastructure is attractive due to its secular tailwinds, the current environment presents specific catalysts that make social infrastructure investments particularly compelling. For instance, the recent increase in interest rates has led to declining property valuations and a steep rise in borrowing costs. In certain cases, this can force property owners and developers to sell assets, offering investors the chance to buy high-quality assets and developments at discounted prices.

Moreover, many older buildings fail to meet evolving environmental standards, posing risks of obsolescence. Buildings that do not provide adequate social value to their occupants face similar risks. These factors decrease demand and exert downward pressure on prices, creating opportunities for impact-focused investors to leverage their expertise and capitalise on undervalued assets.

Conclusion: embracing social and environmental impact

In conclusion, social infrastructure investing offers investors an opportunity to generate market-level financial returns while addressing pressing societal and environmental needs. By investing in assets that provide essential services and promote sustainability, investors can play a meaningful role in building resilient communities and creating long-term value.

To learn more about the impact of social infrastructure investing, visit our website.

For Institutional Investors only – not for distribution to retail clients

Investments entail risks, the value of investments can go down as well as up and investors should be aware they might not get back the full value invested.

Franklin Templeton Investment Management Limited (FTIML), registered office: Cannon Place, 78 Cannon Street, London, EC4N 6HL. Tel +44 (0)20 7073 8500. Authorised and regulated in the United Kingdom by the Financial Conduct Authority.

www.franklintempleton.co.uk