A 2024 survey carried out by Legal & General shows that DC contributors have a generally very positive attitude to private markets investing.

As part of our ongoing research into DC clients' requirements, in April 2024 we surveyed 2,024 current DC savers about their knowledge of, and appetite for private market investing.

As well as the overall concept of private markets investments, we dug further into four specific areas: Affordable housing, clean energy, university spin-offs of innovation and technology companies, and unlisted (private) companies.

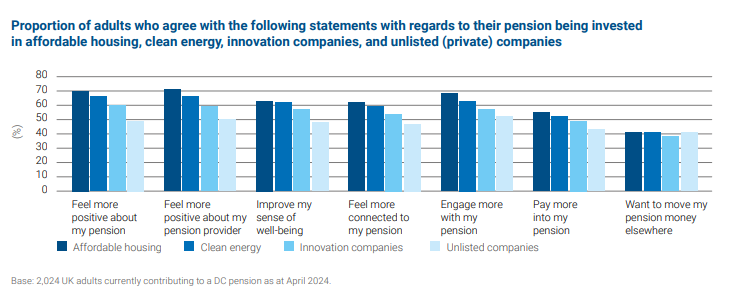

DC members responded to a series of statements covering: How positive they felt about investing in private markets (and the underlying asset classes), whether each asset class would make them feel more positive about their provider, and whether investing in these assets would improve their sense of well-being, feel more connected to their pension, or want to pay more into their pension. Finally, we asked if these investments would make them more likely to move their pension money elsewhere.

We found that 45% of respondents were happy to invest in private markets, but they had clear favourites. Overwhelmingly the first three categories were considered far more positively and the final category, unlisted companies, was viewed more cautiously.

Of particular interest was that one in five (21%) felt that pension money should be used to improve society, while 45% were happy to see a small part of their fund being used to support economic growth.

Feeling positive about private markets investing

Affordable housing was the frontrunner for this question, with 70% of savers saying they'd feel more positive about their pension if its funds were being used to help support affordable housing schemes. Clean energy investing came a close second (66%) followed by innovation and technology (60%) and 49% for private, unlisted companies.

Delivering better returns

DC pension savers also felt that affordable housing would be the most likely to deliver better returns than the other options, with 60% believing that pension companies investing in affordable housing would perform better than those that did not. Comments included:

"I think it's quite a good idea because safe and affordable housing is something which each of us needs on a daily basis. So, I think it's a good investment because you'll always get good returns. If not straight away, maybe within a longer time period. Whether you're rich or poor, you always need to have a safe place to live, so it'll always be demand for this (sic)."

Over half of our respondents (58%) believed that investing in clean energy would result in better financial performance and slightly over half (51%) felt that investing in university spin-out companies working in innovation and technology would lead to better results.

Meanwhile, members' least favourite option of the four we tested was unlisted private markets where only 34% said they believed pension companies investing in this area would perform better than those that did not. This relative unease around unlisted companies could possibly be explained by a perception that emerged during our interviews with DC savers that these businesses are still ‘learning' and investing in them might be risky:

Increasing contributions and paying higher fees

Some of those we interviewed would pay more into their pension schemes to invest in certain areas.

Affordable housing evoked the strongest response with 55% saying they'd be prepared to pay more into their scheme if it was being invested in this way. Clean energy (52%) and innovation and technology (49%) followed on, and again the least popular investment category was unlisted companies, with 43%.

It was a similar picture for whether DC savers would be comfortable paying higher fees for their pension to be invested in these areas. Once again, affordable housing came out top with 61% prepared to pay more, for clean energy and innovation companies the figure was 58%, and for unlisted companies, 41%.

In all categories, the vast majority of those who would be prepared to pay higher fees, would consider an increase of over £50 a year with fewer prepared to go beyond £100.²

What about the risks?

We showed DC pension savers a list of risks associated with private market investments. Our respondents were concerned about all of them. Just 4% had no concerns.

When asked to rank their top three concerns, the potential for fraud or mismanagement in private companies was first (48% ranked it as either their first, second or third concern), followed by investment loss (43%), long time to make money (40%), lack of transparency (40%), less regulatory oversight (37%), and limited information (35%).

Despite awareness of risks, most DC savers supportive

Despite being made aware of the risks, investing in private market assets still seemed to appeal to most of those we surveyed, as only a quarter did not want their money invested in any of the areas tested.

Three in 10 (30%) would need to know more to feel comfortable, while a quarter (24%) simply trusted their pension provider to make the right decisions.

Reassurance and building trust are key

In July 2023, Legal & General joined several UK pension providers in signing the Conservative Government's Mansion House Compact, committing to allocate 5% of default pension fund investments to unlisted equities by 2030.³

In July 2024, the Labour Government announced a pensions review including plans to unlock investment from DC pension schemes to support the UK economy and help boost DC savers' pension pots.4

At the heart of the debate are DC savers themselves. This is their financial future after all, and they deserve to be heard.

There are concerns that need to be addressed if we're to take DC savers with us down this road. We should be clear on details such as the percentage of these type of investments being included in defaults, and make the argument that despite some undeniable risks, there could also be potential benefits – such as from portfolio diversification* and investing in higher growth areas.

Most of all, we need to reassure DC savers that those in charge of pension strategies will maintain due diligence in keeping them under continual review.

1 Research carried out in April 2024 by Ignition House on behalf of Legal & General's asset management division. The research sampled 2,024 people in the UK who were currently contributing to a workplace pension.

2. In terms of how much savers would be prepared to pay, the vast majority of those who said they'd pay more would consider an increase of over £50 a year, with 78% willing to pay more than £50 a year for affordable housing investments, 74% for clean energy, 81% for innovation companies and 73% for unlisted companies. Fewer would be prepared to pay more than £100 a year (36% would pay more than £100 a year for affordable housing assets, 36% would also be willing to pay more than £100 for clean energy, 38% for innovation companies and 33% for unlisted companies.

3. UK Government news story, 10 July 2023: http://www.gov.uk/government/ news/chancellors-mansion-house-reforms-to-boost-typical-pension-by-over- 1000-a-year

4.Chancellor vows 'big bang on growth' to boost investment and savings Government press release, 20 July 2024. https://www.gov.uk/government/news/chancellor-vows-big-bang-on-growth- to-boost-investment-and-savings.

* It should be noted that diversification is no guarantee against a loss in a declining market.

Key Risk Warnings

The value of an investment and any income taken from it is not guaranteed and can go down as well as up, and the investor may get back less than the original amount invested. Past performance is not a guide to future performance. The details contained here are for information purposes only and do not constitute investment advice or a recommendation or offer to buy or sell any security. The information above is provided on a general basis and does not take into account any individual investor's circumstances. Any views expressed are those of LGIM as at the date of publication. Not for distribution to any person resident in any jurisdiction where such

distribution would be contrary to local law or regulation. Please refer to the fund offering documents which can be found at https://fundcentres.lgim.com/.

This financial promotion is issued by Legal & General Investment Management Ltd. Registered in England and Wales No. 02091894. Registered office: One Coleman

Street, London EC2R 5AA. Authorised and regulated by the Financial Conduct Authority.