Author profile

Investment

Slower growth and rising interest rates have tapped the brakes on private deal activity this year. But as banks continue to retreat from lending, we see plenty of opportunity for investors to pick their spots across the broad private credit universe....

Investment

Niklas Nordenfelt, Head of High Yield, and Phillip Stusser, Senior Portfolio Manager at Invesco, discuss how US high yield has fared in the last three major recessions and how this time might be different.

Investment

In the quest for net zero, approaches based solely on emissions could increase portfolio concentration risk, slow the transition and limit investment growth. We highlight an alternative approach.

Investment

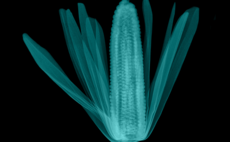

Van Lanschot Kempen believes it’s possible: by investing in regenerative farming

Investment

Why should investors consider rethinking their approach to aligning to net zero? Because in our view many current solutions, which focus on today’s low-carbon companies, have real flaws.

Investment

Investors need to balance concerns about the macro-outlook with exploring exciting micro-opportunities to identify worthwhile sustainable opportunities in 2023, according to Mike Fox, Head of Sustainable Investments at Royal London Asset Management

Investment

Natural capital is an emerging investment class that can provide opportunities to combine financial returns with direct real world impact, helping solve some of the major issues the world faces today.

Defined Benefit

As defined benefit (DB) schemes adopt a holding pattern ahead of a potential buyout, LGIM’s Solutions team – making use of their modelling frameworks – share their insights into how they believe schemes can best invest to meet their objectives.