1. How robust and sustainable will the post-pandemic economic recovery be?

We are already seeing economic activity recover as economies re-open from pandemic-induced shutdowns. The decline and rebound in financial markets have been both sharp and swift, allowing for hope that economic recovery will follow the same path. It is likely too soon to tell just how robust and sustainable the recovery will be at this point, as damage to some parts of the economy will be lasting or even permanent. Moreover, the risks of a second wave of COVID-19 in the fall could imperil recovery trajectories and stimulus efforts.

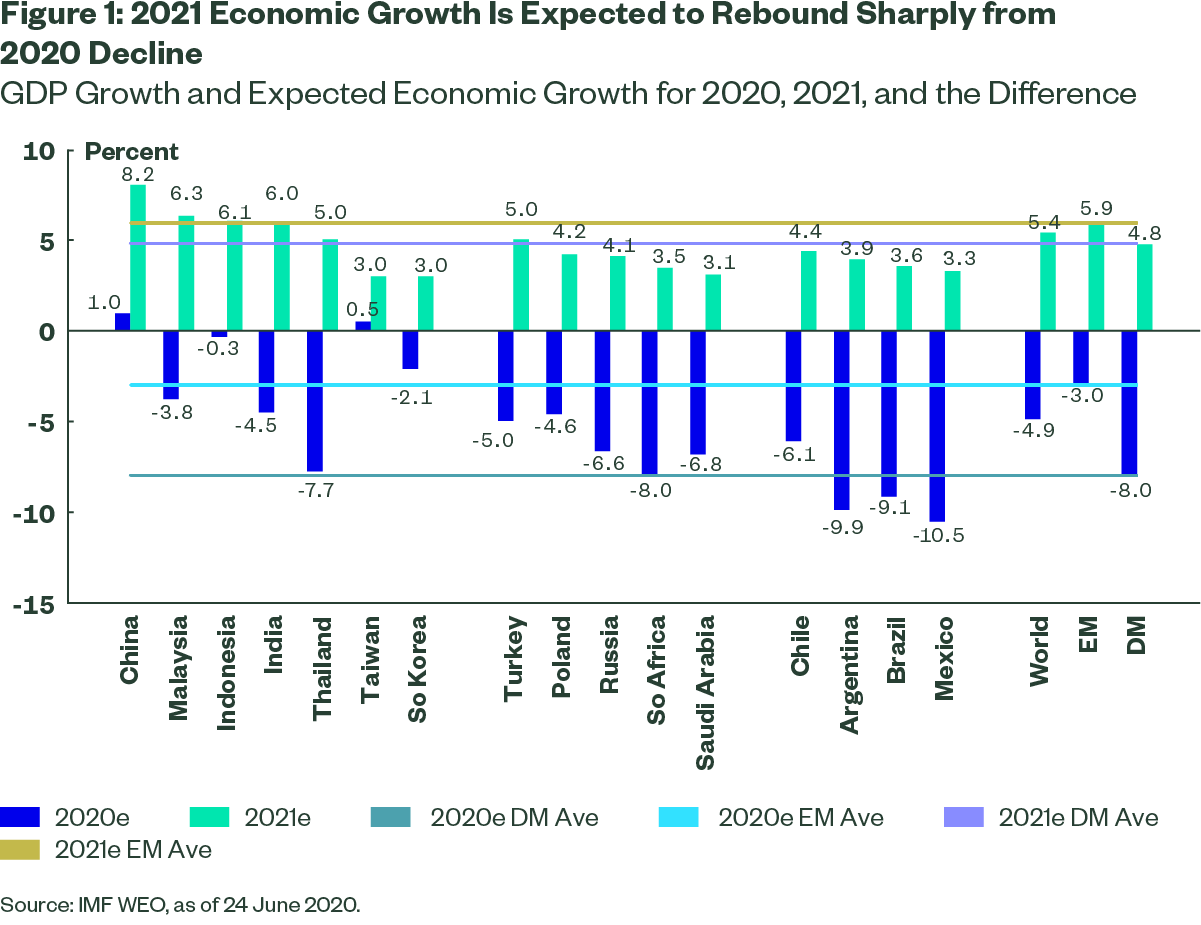

The size and breadth of monetary and fiscal stimulus implemented in the wake of the crisis, globally, is unprecedented. The IMF forecasts shown in Figure 1 suggest sharp economic recovery in 2021, setting real GDP growth firmly back in positive territory. While this is good news, we still do not have much visibility into the sustainability of growth beyond that point. It is also important to keep in mind that not all emerging markets are the same, and that high economic growth doesn't always translate into great equity performance. A strong rebound in economic activity will naturally turn the spotlight toward economically sensitive companies. Further, the extent to which interest rates increase will begin to diminish one of the favorable catalysts behind the strong performance of growth stocks.

2. Will EM policymakers be able to tighten monetary policy and tackle large fiscal deficits when economic conditions improve?

Not all emerging markets are alike, and not all emerging market policymakers responded to the economic crisis in the same way, with the same policy tools, or to the same degree. They all did, however, respond in the same direction by providing fiscal stimulus, lowering official rates, and freeing up liquidity in banking systems. The difference for emerging markets in this crisis, compared to past crises, is that EM policymakers were able to lower rates along with policymakers in advanced economies. In some cases, EM central bankers were able to use policy tools such as quantitative easing (QE) that were once only accessible to advanced economies. EM policymakers also announced fiscal stimulus packages of varying sizes and shapes.

Because recent EM policy responses contrast with those that were afforded to EM in the past (e.g., higher rates, tighter fiscal policy to thwart capital outflow and currency weakness), we expect to see EM economic growth recover more quickly, but at the cost of higher fiscal deficits and potentially higher inflation. In some countries, this may lead to sharp upward adjustments in interest rates. Countries with strong institutions and credible policymakers should be best suited to normalize policy when conditions improve.

Marketing Communication

State Street Global Advisors Worldwide Entities

For use in EMEA: The information contained in this communication is not a research recommendation or ‘investment research' and is classified as a ‘Marketing Communication' in accordance with the Markets in Financial Instruments Directive (2014/65/EU) or applicable Swiss regulation. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Important Risk Information

The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. You should consult your tax and financial advisor. All information is from State Street Global Advisors unless otherwise noted and has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

The views expressed are the views of the Fundamental Growth and Core Equity team through August 27, 2020 and are subject to change based on market and other conditions. This document contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Investing involves risk including the risk of loss of principal. Quantitative investing assumes that future performance of a security relative to other securities may be predicted based on historical economic and financial factors, however, any errors in a model used might not be detected until the fund has sustained a loss or reduced performance related to such errors.

The trademarks and service marks referenced herein are the property of their respective owners. Third-party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA's express written consent.

© 2020 State Street Corporation.

All Rights Reserved.

Exp. Date: 09/30/2021

3275321.1.1. EMEA.INST