The European bond market is modernising at a rapid pace - and fixed income exchange-traded funds (ETFs) are playing a crucial role in driving this progress. ETF liquidity, price transparency and versatility are propelling many of the developments we see in the market today and are supporting a more robust and structured bond ecosystem.

Over the past five years, the European corporate bond market has grown by 56% to €2.8 trillion in debt outstanding [Source: Bloomberg Barclays and ICE benchmark indices, as at 30 Jun 2020]. Favourable pricing has attracted corporates to Europe's bond markets, reducing a traditional reliance on bank loans, while international issuers have sought to diversify their funding sources. Strong investor demand, particularly from the ECB, has also driven growth.

Despite the strong growth in issuance, secondary market bond liquidity has remained challenging in Europe, given the market's bilateral and over the counter (OTC) trading nature. While a number of tailwinds have contributed to improvements, such as regulatory reforms, the wider adoption of index-based products, and the growth of electronification which is aiding the transparency, choice of trading venues and overall ecosystem efficiency, the improvement has not been uniform.

The environment in which European pension funds operate continues to present challenges. Evolving regulations, persistently low yields, ageing populations, and pandemic driven volatility and uncertainty, is forcing Defined Benefit (DB) to re-think portfolio construction and identify portfolio tools to ensure they have the flexibility and agility to pilot to toward their de-risking goals. ETFs deep liquidity and price transparency have become increasingly attractive features in this regard.

The rise of fixed income ETFs

The evolution of the bond market and adoption of fixed income ETFs accelerated even further following the Covid-19 selloff, which highlighted many of the challenges that an opaque bond market presents to institutional investors.

Fixed income ETFs have grown rapidly in recent years. The US$284 billion European UCITS-listed ETF market is the largest in the world after the US, with a five-year compound annual growth rate of 21%. [Source: BlackRock, GBI, 30 Jun 2020].

The volatility through 2020 demonstrated that managing fixed income allocations through individual bonds can be challenging. The lack of liquidity and price discovery in the underlying markets saw portfolio managers and traders use fixed income ETFs to understand rapidly changing market conditions; to help price individual bonds and portfolios; to determine absolute and relative value opportunities; to implement decisions rapidly and efficiently; and to hedge unwanted risk. ETFs provided investors with deep liquidity, continuous price transparency and lower transaction costs than were available in individual bonds during this period.

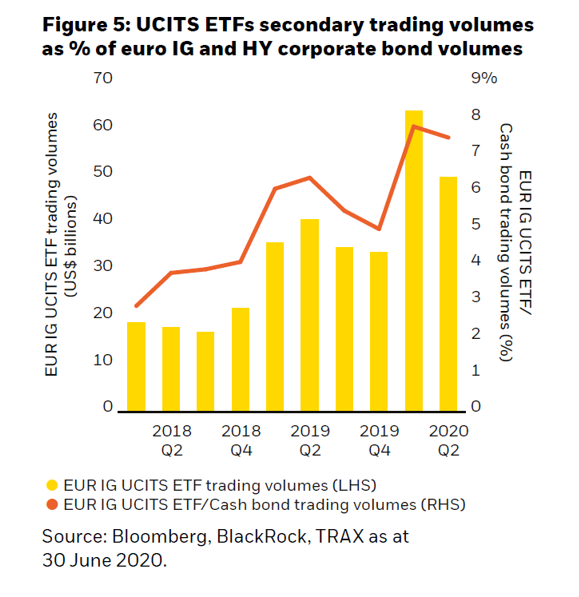

UCITS fixed income ETFs traded an average of US$5.3 billion a day in March 2020, almost twice the 2019 daily average of US$2.9 billion [Source: BlackRock, Bloomberg, as at 30 June 2020]. On 12th March 2020, shares in a single US$ investment grade 40Act and UCITS ETF traded over 100,000 and 1,000 times respectively, while their top five underlying holdings traded an average of only 37 times each, and during March more than half the bonds in the index the ETF follows traded between zero and five time per day on average. A similar pattern of trading was also experienced in the Euro corporate bond market. [Source: Blackrock, TRACE as of 24 March 2020]. Fixed income ETFs provided actionable prices for investors at a time when the underlying bond market was challenged.

The relationship that European pension schemes have with fixed income markets is becoming more entwined, with fixed coupon and long-term inflation linked income streams remaining the backbone of pension fund asset allocations. Institutional investors like pension schemes are becoming increasingly confident that they can use fixed income ETFs at the large scale they require and commonly use fixed income ETFs for liquidity management, tactical asset allocation, and as replacements for derivatives. Many European pension funds have already adopted FI ETFs to help achieve their long-term funding aspirations, allowing them to become increasingly tactical and nimble, as well as precise in their Fixed Income asset allocation.

Institutional investors have bought blocks of €500 million and above in iShares European bond ETFs [Source: BlackRock, Bloomberg, as at 31 May 2020].

ETF ecosystem is coming of age

As the ETF industry grows, so too does its ecosystem which is developing across a number of lenses.

Electronification has expanded the choice of trading venues and protocols for investors and has allowed liquidity providers to rapidly price and trade portfolios of bonds to facilitate fixed income ETF creation and redemption. The rise of algorithmic bond pricing has accelerated the adoption of electronic trading and alternative bond trading architecture. MiFID II was an important regulatory development in 2018 driving greater transparency and consolidation for the market. Together many of these factors are supporting a noticeable growth in fixed income ETF lending and options markets.

The lending of fixed income ETFs has been an important development in the underlying market's liquidity. The stock of EMEA-listed fixed income ETFs available for borrow has increased by more than 60% in the past three years, to reach US$14 billion in June 2020. Balances on loan have more than quadrupled [Source: IHS Markit. Data as at 30 June 2020] The expansion of fixed income ETF lending has in its turn enabled the development of options contracts. The European market is still relatively small, but the large size of the corresponding US market suggests that options in fixed income ETFs will eventually become widespread in Europe as well.

ETFs are becoming the tool of choice for fixed income investors

The path forward for pension funds remains long. Schemes are increasingly managing their fixed income exposure through a portfolio lense and using a broader toolkit to develop the access and flexibility required to achieve their long-term funding targets. As their journey evolves, it is paramount that portfolio managers understand modernisations within the bond market to better achieve their fundamental responsibilities to pension participants. Fixed income ETFs are helping to create more portfolio flexibility, reduce complexity and streamlining the portfolio construction and risk-management process.

"Fixed income ETFs have become an essential component of fixed income investors' toolkit. They have added liquidity and transparency to the bond markets via a diversified tradable product. We see ETFs used across the fixed income landscape alongside other index instruments, such as CDX, Standardized iBoxx Total Return Swaps and futures, with ETFs often the central driver of liquidity." - Srichandra Masabathula, Index Product Manager, IHS Markit

You can contact Justin Wheeler at the following

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or financial product or to adopt any investment strategy.

Risk Warnings

Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy.

Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially. Levels and basis of taxation may change from time to time.

Important Information

This material is for distribution to Professional Clients (as defined by the Financial Conduct Authority or MiFID Rules) only and should not be relied upon by any other persons.

In the UK and Non-European Economic Area (EEA) countries: this is Issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: + 44 (0)20 7743 3000. Registered in England and Wales No. 02020394. For your protection telephone calls are usually recorded. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock.

Any research in this document has been procured and may have been acted on by BlackRock for its own purpose. The results of such research are being made available only incidentally. The views expressed do not constitute investment or any other advice and are subject to change. They do not necessarily reflect the views of any company in the BlackRock Group or any part thereof and no assurances are made as to their accuracy.

This document is for information purposes only and does not constitute an offer or invitation to anyone to invest in any BlackRock funds and has not been prepared in connection with any such offer.

© 2021 BlackRock, Inc. All Rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, iSHARES, BUILD ON BLACKROCK and SO WHAT DO I DO WITH MY MONEY are trademarks of BlackRock, Inc. or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners.