18 months on from the UK entering its first lockdown, we are launching this special report on how the pension risk settlement market has fared over the Covid-19 era.

The headlines:

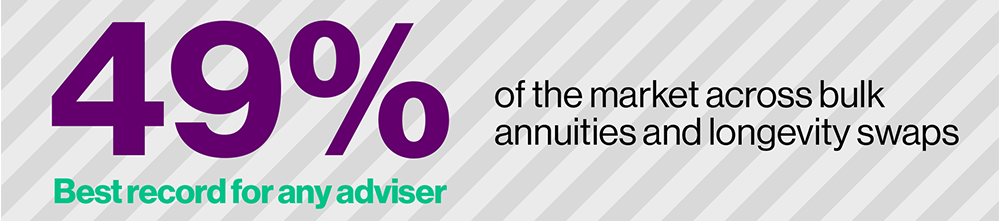

The market for risk settlement has been incredibly robust over the course of 2020 and 2021, as well as offering some exceptional pricing opportunities. We are very proud that Willis Towers Watson has been at the forefront of this. We have been the lead trustee adviser on:

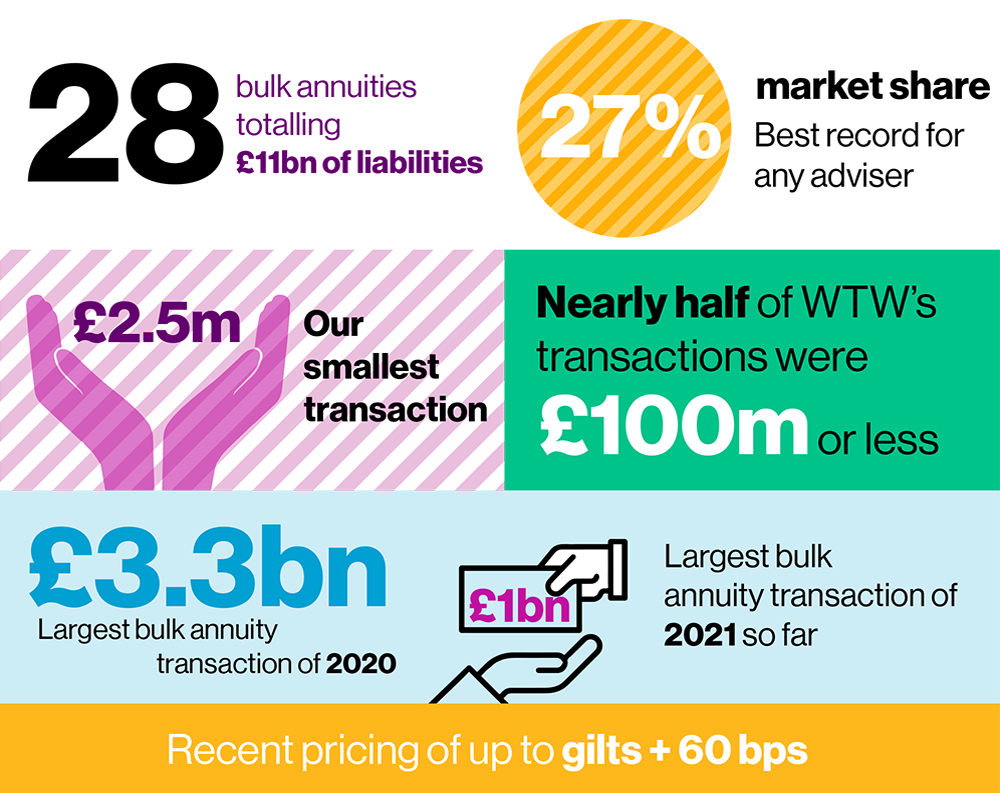

- 28 bulk annuities totalling over £11bn of liabilities, representing over a quarter of the market

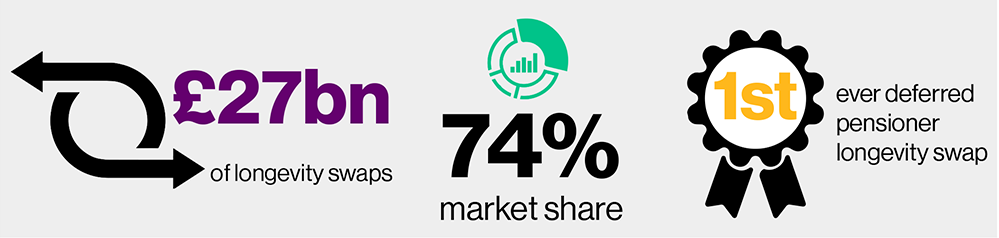

- 6 longevity swaps covering £27bn of liabilities, representing a huge 74% of the market

- The first-ever deferred pensioner longevity swap, for AXA

- At £3.3bn, the largest bulk annuity transaction of 2020

In this special report, Ian Aley, head of transactions and Shelly Beard, senior director of transactions, review the last 18 months and what lies ahead for these markets.

Willis Towers Watson's record since 1 January 2020 in numbers

Bulk annuities

Longevity swaps

Overall volumes of longevity risk transfer

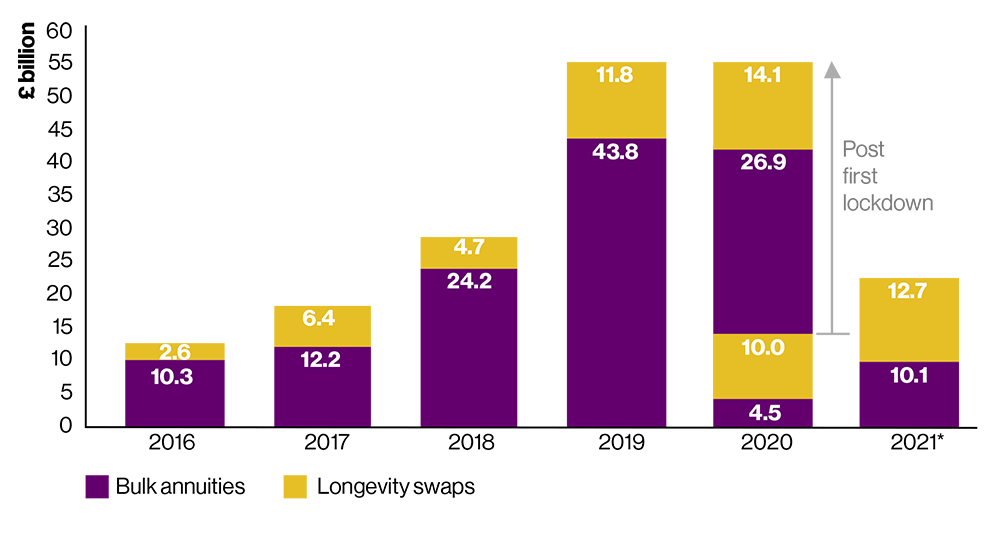

As can be seen in Figure 1, the bulk annuity and longevity swap markets remained incredibly busy despite the challenges of Covid-19. In fact the period immediately following the first lockdown in March 2020 was one of the busiest periods the market has experienced.

Figure 1: Bulk annuity and longevity swap volumes since 2016

The bulk annuity market

Since March 2020 over £37 billion of bulk annuities have been announced. Importantly, many transactions achieved some of the best pricing (relative to gilt yields) ever available in this market, particularly those that were able to move quickly and transact in April 2020 when credit spreads were at their widest.

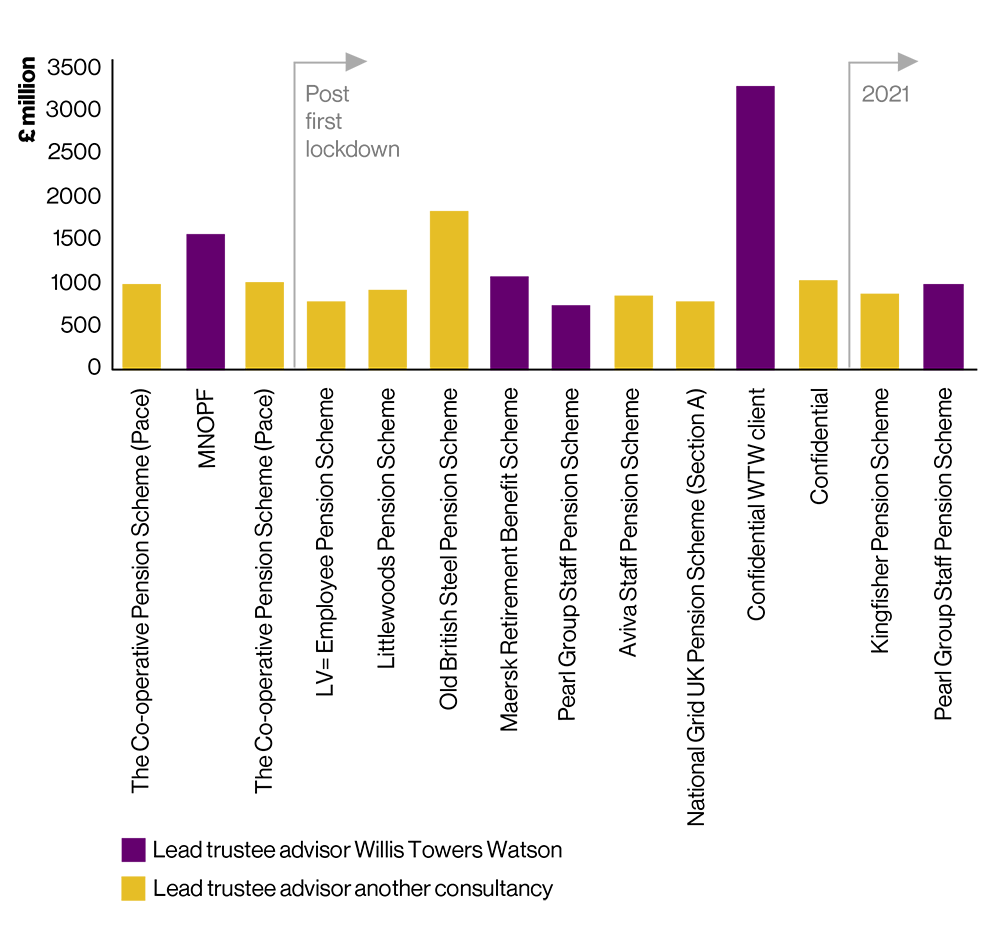

The market was also very active across all sizes of transactions and our team led over a quarter of the deals, acting as lead adviser across the entire breadth of the market. Our work here included leading the largest bulk annuity of 2020, a £3.3bn pensioner buy-in with Rothesay and also the largest bulk annuity so far in 2021, a £1bn buy-in for the Pearl Group Staff Pension Scheme. At the smaller end of the market, we've led buyouts for two £10m schemes as well as a £2.5m buyout for the BHS Senior Management Scheme.

Figure 2: bulk annuity transactions over £750m by lead trustee adviser since 1 January 2020

Bulk annuity market share by lead trustee adviser since 1 January 2020

Source: Willis Towers Watson, September 2021

Given the extreme events in the wider world, the market's resilience is testament to the dedication of everyone involved. Despite the hugely challenging environment, trustees and sponsors continue to focus on de-risking opportunities and increasing security for their membership. Insurers quickly transitioned to working at home - in fact we led a £300m buy-in that signed just two days into the first lockdown!

Looking forward we continue to see significant opportunities in the bulk annuity market. A slightly quieter year so far has resulted in a hugely competitive market offering incredibly compelling pricing. We have observed pensioner buy-in pricing of up to gilts + 60bps pa. The same is true in the buyout space, with one of our clients recently achieving buyout pricing around 10% cheaper than their actuary's estimate.

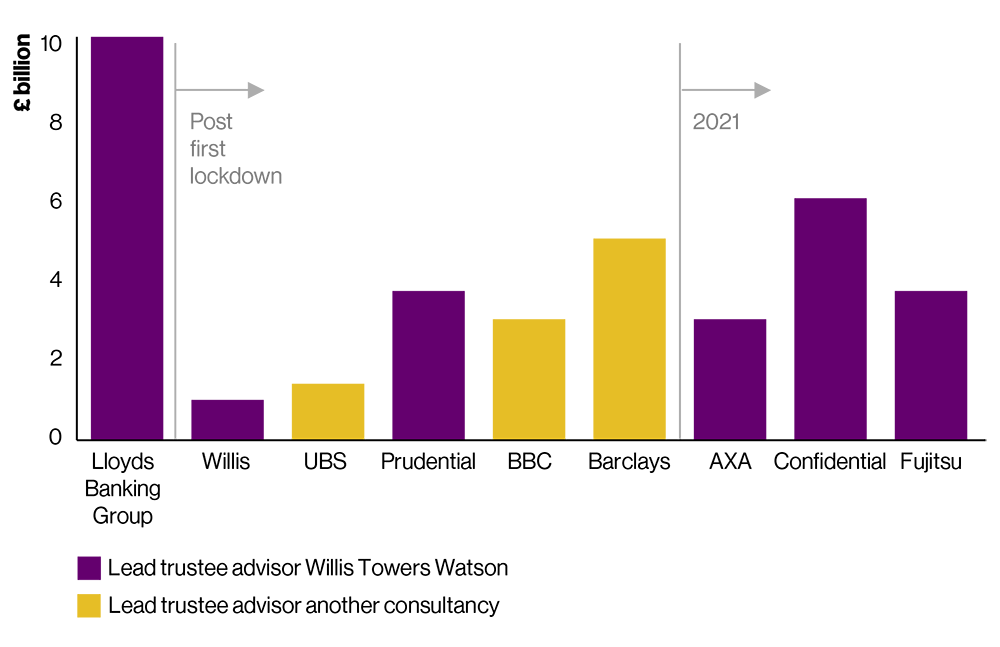

The longevity swap market

Since March 2020 eight longevity swaps have been announced, covering over £25 billion of liabilities, extending what was already one of the busiest periods in the market's history. Unlike the bulk annuity market where risk transfer reverted to 2018 levels, the longevity risk swap market continued to grow. Willis Towers Watson led five of these deals - 65% of the market - guiding our clients through these complex projects, leveraging our provider relationships and unrivalled experience. This included the market's first deferred member longevity swap, a significant innovation.

Figure 3: Longevity swap market share by lead trustee adviser since 1 January 2020

Longevity swap market share by lead trustee adviser since 1 January 2020

Source: Willis Towers Watson, September 2021

A key question that clients asked was whether hedging longevity remained sensible in the context of the pandemic and we looked at this through several different lenses, including weekly monitoring of scheme- specific death figures for schemes and undertaking in-depth risk analyses. An interesting insight from this analysis was how differently pension scheme members were affected by the pandemic relative to the general population, with many schemes remaining largely unaffected.

For most pension schemes, longevity risk is now one of the largest, if not the largest, unmanaged risks they run. Combine this with the fact that longevity is generally regarded as an unrewarded risk and it's easy to understand why many of our clients are using recent funding level improvements to hedge it.

On the supply side, reinsurer pricing is at historically low levels relative to pension scheme reserves, driven by increased competition from new entrants to the market and greater appetite from existing reinsurers.

With this attractive pricing looking likely to continue for the next 12 months, we expect the market to continue to be very active. We anticipate pricing opportunities will arise for schemes with more blue-collar liabilities, as providers look to diversify portfolios following the large number of recent deals involving schemes with sponsors in the financial services sector.

Looking ahead

After proving themselves robust over the past 18 months, particularly in the case of the longevity swap market, we expect the de-risking markets to be incredibly busy in 2022 as schemes take advantage of recent funding level improvements and reduce risk.

As schemes define their long-term objectives and consider the best de-risking steps, it will be important to partner with an adviser with an in-depth understanding of all of the market options. Please get in touch if you'd like to discuss options for your scheme

Market share by lead trustee adviser across bulk annuities and longevity swaps since 1 January 2020

Source: Willis Towers Watson, September 2021

To find out more about how we can help you, please visit our Pension Scheme Transactions service page

Our strength is our depth - meet our team of transaction leaders.

Ian Aley - Head of Transactions, email

Shelly Beard - Senior Director, Transactions

Gemma Millington - Senior Director, Transactions

Sadie Scaife - Senior Director, Transactions

Matt Wiberg - Senior Director, Transactions

Costas Yiasoumi - Senior Director, Transactions