Why Asia?

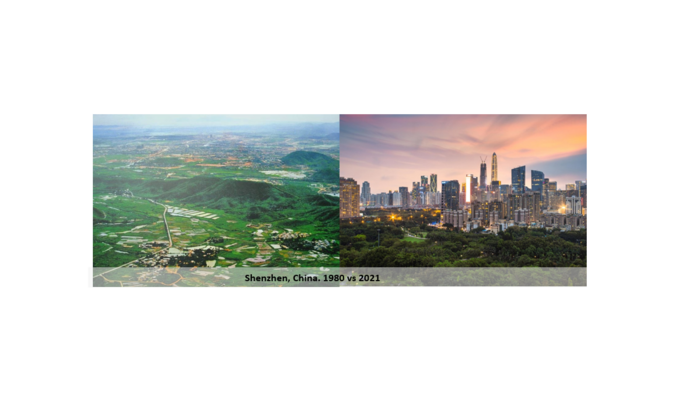

Asia is home to a rich, diverse opportunity set full of change and underappreciated growth, now more so than ever. The unrelenting force of technological change, supported by a huge pool of talent, is generating new opportunities to create value in Asia. The confluence of urbanisation and a rising middle class, coupled with the rapid adoption of next generation technologies, is creating an environment rife with innovation, disruption, and change. We believe these changes will propel productivity forward and help drive rapid growth in domestic consumption across the region. This growth and the sheer size of the market opportunity in an interconnected Asian economy, is helping to create larger domestic companies and global champions. Meanwhile, increased financialisation of the domestic markets, is opening more opportunities for domestic and foreign investors. As a result, Asian companies are amongst the fastest growing globally and offer significant potential upside over the coming years.

Why Growth?

In rapidly growing and changing markets, where today's winners may be tomorrow's losers, looking for and finding growth the great growth businesses, we believe, is key to driving long-term returns in the Asian markets.

Over the past decade e-commerce, especially in China, has been a huge success story. Understanding, how and why the Chinese especially would adopt e-commerce more rapidly and in a different fashion to the West was key. A younger population, less existing infrastructure or sunk costs and lastly an emotional bias that embraces change, all leads to greater innovation and greater absorption of new trends and fashions. However, we are not so sure that this story is not itself disrupted by more innovative companies: those offering e-commerce via social media, group buying or local O2O rapid delivery services. The fund being unconstrained by the benchmark in terms of stock, country and sector exposure, can find the next great growth stories, regardless of benchmark weight or historic returns.

We are looking for unanticipated growth, we tend to break this down into 3 separate categories:

Velocity & Acceleration

These are companies which the market believes are growing at earnings at 25-35% over the next three years, however, we believe earnings growth could accelerate and will compound at 40%, 60% or even 100% over next three to five years.

For example, Nasdaq-listed Sea Limited is a Singaporean technology company that started in gaming, expanded to e-commerce, and is now deepening in financial services. It has delivered a compound growth of 110% over the last five years. By recognising the diverse challenges of Latin America e-commerce have similar patterns, to what they experienced in Southeast Asia, Sea Limited has exported its formula there, and we believe they can replicate their fantastic success story.

Renewal and Regeneration

These are companies with no growth and where we see a change appearing such as rapid earnings growth in next 3 to 5 years, factors include management change, economic cycle, and new business models.

Tata Motors, owns the Jaguar Land Rover franchise and a domestic India auto business. We see change in the senior management team, a new product cycle and a new lean cost structure, which will drive significant earnings growth in any upcycle. Maybe, most importantly, we see a shift in emphasis towards electric vehicles, where Jaguar may emerge as one of the world pre-eminent electric vehicle brands.

Patient and Persistent

These are great growth businesses, with strong management teams and business models where we believe growth and cash flows will last much longer than market expects.

Dual-listed in Hong Kong and Shenzhen, Ganfeng Lithium is a Chinese lithium metals producer, lithium being a primary ingredient in lithium-ion batteries, used to power electric vehicles. Despite its history as a midstream producer, it presciently moved upstream to first secure lithium as a raw material, then is now moving downstream to battery production & recycling to fill out the supply chain. This mission of building a global, one-stop, full lithium lifecycle firm is ambitious, difficult, but ultimately likely to be worthwhile - for all of us.

The actively managed CRUX Asia ex-Japan Fund launched in October 2021, with a full team of Asian specialists including two analysts and Damian Taylor as a second fund manager. The fund looks for companies which will aim to double their revenue and/or earnings over a 3-5-year period. This longer than average timeframe allows the investment team to find hidden gems which are often overlooked by the market, which typically forecasts out earnings over a 2-year period.

By anticipating change, embracing uncertainty and having the courage to invest in companies at their pivotal moments of growth the CRUX Asia ex-Japan Fund is well positioned to cut through the noise, capture unique growth opportunities and deliver long-term returns.