Key points

- Loans have delivered more resilient performance this year relative to other credit markets.

- With global recession concerns brewing, will the loan market be able to continue to ride through the market volatility?

- We consider this by unpicking some of the myths around loans to see whether they are a potential way to stay afloat amid choppy waters and capture relative value.

Liquidity in fixed income markets has become more challenged given the fall-out from liability-driven investment (LDI) selling.

With recession and energy crisis worries, head of loans David Milward discusses whether loans can continue to show resilience through the market volatility.

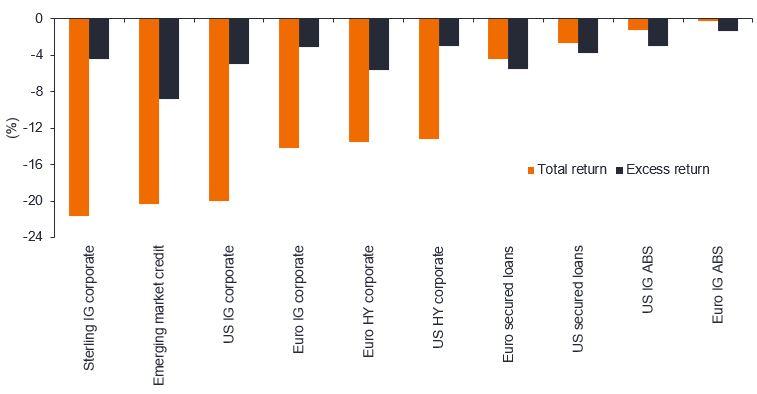

As we approach the close of 2022, it has no doubt been a volatile year for risk assets, with investors struggling for places to hide from the market mayhem. While loans have not escaped the synchronised sell-off, total and excess returns suffered the least along with asset backed-securities (ABS) over the year to date (Figure 1). High yield (HY), for example, endured double-digit losses. This is partly attributable to the sharp repricing in short-term interest rates, which is generally beneficial for floating rate assets such as loans, as it will drive overall returns higher. As retail investors are significant participants in credit markets, this leaves them arguably more susceptible to selling pressure compared to the ‘stickier' capital provided by collateralised loan obligations (CLOs) investors, who constitute more than 50% of the loan market in Europe.

Figure 1: European loans resilient in 2022

Source: Janus Henderson Investors, ICE BofA, Credit Suisse, Barclays, 1 January to 31 October 2022. Note: Excess return: fixed rates vs swaps, floating rate less Libor. HY = high yield. IG = investment grade. ABS = asset-backed securities. Any differences among portfolio securities currencies, share class currencies, and your home currency will expose you to currency risk. Past performance does not predict future returns.

With global recession concerns brewing, will the loan market continue to ride the market volatility? Here we consider this by unpicking some of the myths around loans.

Myth: CLOs will be significant forced sellers of loans

The CLO market is a key driver of European loan market liquidity. Despite material spread widening over the past few months (partly due to the liability-driven investment or LDI crisis, which has forced pension schemes to liquidate assets to raise additional collateral), CLO deals are still being printed. So far this year, there has been EUR€21.4 billion of new issues from 54 deals1. The latest issuance forecasts for 2023 are wide ranging (EUR€23-38 billion2), but encouragingly this market remains open and at healthy levels of expected issuance.

As credit quality inevitably deteriorates amid the economic downturn, a key risk facing CLOs - and therefore loans - is a rise in CCC ratings that might impact CCC buckets and thus over-collateralisation3 (OC) tests. As such, investors are increasingly nervous about holding low B-rated names, particularly in more cyclical sectors, which has exacerbated some of the sharp price moves. That being said, CLO managers are not automatic forced sellers of CCC or low-priced assets. The structures typically allow a portfolio to hold up to 7.5% CCC-rated assets with no consequence (ie. the loans continue to be valued at par for OC purposes). If this limit is breached then the excess must be priced at market value for the OC tests. But even then, the CLO is not a forced seller of these assets.

1 Source: LCD, JP Morgan, Janus Henderson Investors Analysis, as at 31 October 2022.

2 Source: Morgan Stanley, Bank of America, Deutsche Bank, JP Morgan, BNP Paribas and Barclays, as at 1 November 2022.

3 A measure of the cushion available to absorb any defaults within the portfolio of loans for each tranche of CLO debt.

Risk Warnings

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. Any securities, funds, sectors and indices mentioned within this article do not constitute or form part of any offer or solicitation to buy or sell them.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

This post is funded by Janus Henderson Investors