LGIM discusses ways for defined benefit (DB) schemes to build a stable liquidity pool, while balancing future returns and considering the importance of deep liquidity in light of the significant gilt market volatility of 2022.

2022's significant gilt market volatility threw a spotlight on the importance of deep liquidity. Here's our latest thinking on what tools DB schemes may have available to help build a diverse and stable liquidity pool, while still keeping one eye on future returns.

As DB schemes look to the future and aim to build resilience to market shocks, many will be considering enhancing the mix of assets they hold within the 'top-up' funds that sit beside their liability-driven investment (LDI) portfolio. As a broad rule of thumb, we believe approximately 50% of the assets held in LDI strategies should be held in liquid funds alongside, to help ensure an appropriate amount of assets can be accessed quickly if necessary.

However, these assets do not all have to be held as cash. This is important for most schemes, as while to do so might meet their objectives of having scheme stability and ready liquidity, it would be likely to compromise their other objectives of delivering growth and generating stable cashflows sufficient to pay pensions (Figure 1). Instead, including a dedicated allocation to assets focussed on providing a more liquid and stable return than broader market assets can materially improve the liquidity profile of a scheme. We believe that these assets can complement existing holdings and potentially offer predictable cashflows and maintain expected returns in excess of gilts to help close funding gaps and keep DB schemes on their journey towards endgame.

Why do we need liquidity?

Traditionally, much of the focus with liquidity has been on holding assets that can generate sufficient regular cashflows to pay pensioner liabilities. This, of course, remains very important. Yet in 2022's market turbulence it wasn't known cashflows that presented the real challenge for DB schemes. Instead, this was caused by a series of unknown cashflows (Figure 2) as schemes were required to post additional collateral as the value of government bond holdings fell. And with gilts themselves often a go-to asset for liquidity, many schemes were required to raise cash by selling the very asset that was falling sharply in value.

Extreme as it was, this market backdrop demonstrates why it's crucial for schemes to have several additional taps - a diverse source of liquidity - that can be turned on if they're needed, in addition to the regular plumbing required to pay pensions. A further reason why schemes need a resilient plan for liquidity is that there are other potential unknown cashflows to prepare for too.

Transfer values out of schemes are inherently unpredictable and can be significant, particularly for smaller schemes where senior staff members can hold a significant percentage of the overall scheme. Commutations - where members sacrifice future pension payments in exchange for an immediate lump sum - also need to be taken account of in liquidity planning, as do private asset capital calls, with both the amount and timing of when illiquid asset managers need to draw down on further capital often unknown.

Encouragingly, today's higher yielding bond environment, coupled with the fact that scheme funding levels have risen on balance, means that holding a greater allocation to more liquid assets could now come with a lower opportunity cost.

What factors drive the liquidity of an asset?

Perhaps the most obvious consideration when assessing an asset's liquidity is the size of the market. The larger the market, the deeper the available liquidity pool, as the ability for that market to withstand trades tends to be higher. How often assets are traded is also clearly important: if assets aren't traded very often, their liquidity will generally be lower, even if the actual size of the market is significant.

There's a third factor that's also crucial: who holds the underlying assets? If assets are overwhelming owned by similar investors, this can present liquidity challenges. That's because if an investor needs to sell an asset to meet liquidity requirements, there's good chance that other investors in the same market sector also need to sell for similar reasons, thereby reducing an asset's liquidity when it's most needed. With around 50% of sterling corporate bonds owned by UK pension schemes1, 2022 brought the importance of understanding this factor - and diversifying accordingly - into sharp focus.

Pensions schemes need consider price clarity when gauging liquidity too. In other words, is an asset regularly marked to market? Additionally, investment and central banks' willingness and ability to keep assets on their balance sheet needs to be taken into account: in times of financial pressure, these institutions can support liquidity by buying when others need to sell, but they're only likely to do so with assets that they are keen and able to hold.

Stability of returns is equally as important

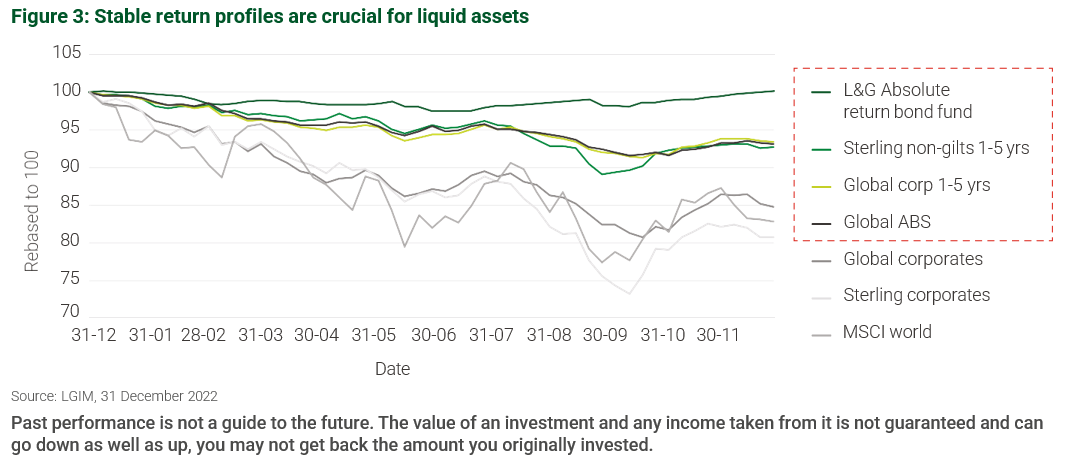

The second key aspect to consider when building an allocation to more liquid assets is their stability. In fact, we believe that stability is just as important as liquidity. That's because it's not particularly helpful to own an asset that's extremely liquid if it's also fallen significantly in value at the same time as you need to sell it.

Using 2022's turbulence in both risk assets and interest rate markets as a case study, several asset classes, including longer-dated bonds and equities saw falls of 20% or more in relatively short order (Figure 3). Equities, in particular, remained highly liquid, but actually using them for liquidity would have entailed crystalising significant losses. For pension schemes, therefore, it's the combination of liquidity and stability that is absolutely crucial, particularly at times of sharp moves in either inflation or interest rates.

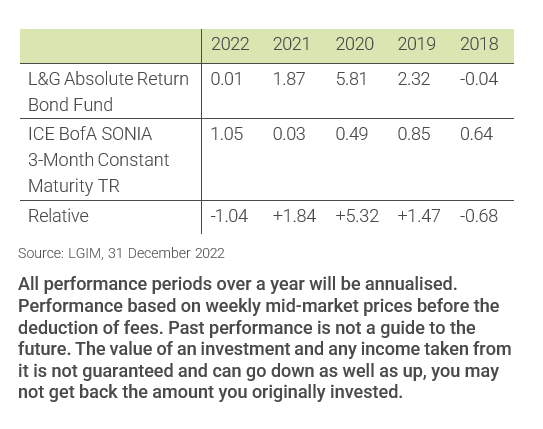

In this vein, LGIM's Absolute Return Bond Fund exhibited greater stability than traditional credit strategies and equities during 2022, and particularly during the large market moves in the third quarter of the year; it also remained highly liquid throughout, meeting 100% of redemption requests (despite them amounting to over 50% of its total value going into the period), with trading costs averaging only 0.23%, compared with 0.17% in standard market conditions.

What does this mean for portfolios?

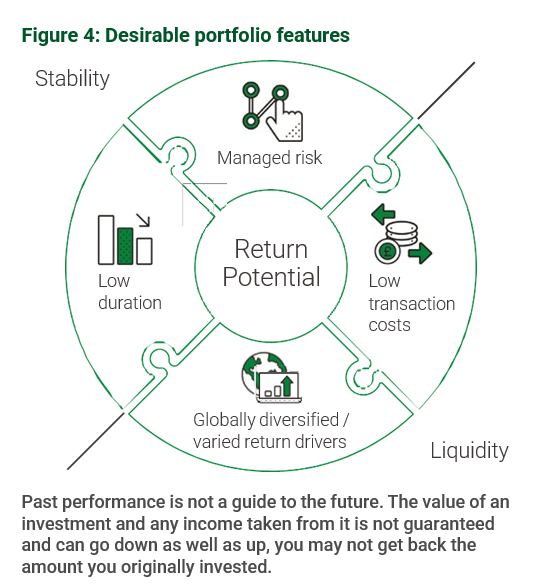

Bringing this all together, we can see that DB schemes need to build portfolios that - in addition to generating cashflow to pay pensions as they fall due - offer a broad pool of liquidity with varied return drivers that is diversified across several asset types and regions. It's these diverse sources of liquidity that schemes can potentially look to draw upon in the event of unknown cashflow requirements, in a range of different market environments.

Figure 4 describes the typical features we believe are desirable to enhance both liquidity and stability. The need for liquidity and low trading costs should be carefully balanced in portfolios with a focus on downside risk management and reduced correlations to interest rates by focussing on lower duration assets, to reduce the chances of having selling assets that have fallen significantly in value. Depending on their need to close funding gaps, schemes can also look for portfolio assets that aim to offer additional growth potential, while also retaining a balance of liquidity and stability.

How can LGIM help to meet your scheme's needs?

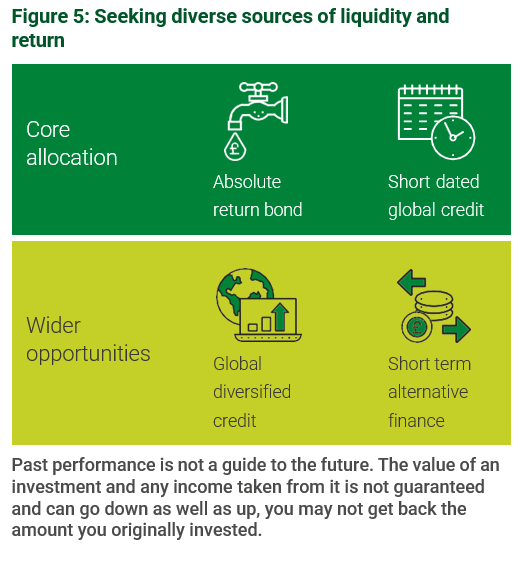

Defined benefit pension schemes can access a wide range of fixed income opportunities at LGIM that seek to offer both diverse sources of liquidity and stability while retaining the potential for returns in excess of cash (Figure 5).

For schemes happy to trade some short-term stability to seek greater potential long-term returns, we also offer a range of diversified growth strategies and index equity funds.

Contact us

For further information about LGIM, please visit https://www.lgim.com/ or contact your usual LGIM representative

1. Source: Pension Protection Fund's Purple Book 2022. *Please refer to the prospectus of the fund and to the key investor information document before making any final investment decisions. For further information please visit our fund centre LGIM Fund Centre

Key risks

Past performance is no guarantee of future results.

The value of an investment and any income taken from it is not guaranteed and can go down as well as up, you may not get back the amount you originally invested.

Further information on the risks of investing in this fund is contained in the Prospectus available at www.legalandgeneral.com/reports

The fund could lose money if any institutions providing services such as acting as counterparty to derivatives or other instruments, becomes unwilling or unable to meet its obligations to the fund.

The fund holds bonds that are traded through agents, brokers or investment banks matching buyers and sellers. This makes the bonds less easy to buy and sell than investments traded on an exchange. In exceptional circumstances the Fund may not be able to sell bonds and may defer withdrawals, or suspend dealing. The Directors can only delay paying out if it is in the interests of all investors and with the permission of the fund depositary.

The fund invests directly or indirectly in bonds which are issued by companies or governments. If these companies or governments experience financial difficulty, they may be unable to pay back some or all of the interest, original investment or other payments that they owe. If this happens, the value of the fund may fall.

Investment returns on bonds are sensitive to trends in interest rate movements. Such changes will affect the value of your investment.

Derivatives are highly sensitive to changes in the value of the asset on which they are based and can increase the size of losses and gains. The impact to the fund can be greater where derivatives are used in an extensive or complex way.

The fund may have underlying investments that are valued in currencies that are different from EUR. Exchange rate fluctuations will impact the value of your investment. Currency hedging techniques may be applied to reduce this impact but may not entirely eliminate it.

We may take some or all of the ongoing charges from the fund's capital rather than the fund's income. This increases the amount of income, but it reduces the growth potential and may lead to a fall in the value of the fund.

The fund is a Target Return fund. This type of fund tries to increase the value of your investment over a period of time, in both rising and falling markets. However, there is no guarantee of returns. You may not get back the money you invest. Target Return funds use a range of different types of investment strategies and may use derivatives. It is possible that the value of these funds could go down when the market is rising, or may not rise as quickly.

Prices of the ABS/MBS may be volatile, and will generally fluctuate due to a variety of factors that are inherently difficult to predict. In addition, the terms of the ABS/MBS may restrict its sale in particular circumstances.

Important information

The information contained in this document (the ‘Information') has been prepared by Legal & General Investment Management Limited, Legal and General Assurance (Pensions Management) Limited, LGIM Real Assets (Operator) Limited, Legal & General (Unit Trust Managers) Limited and/or their affiliates (‘Legal & General', ‘we' or ‘us'). Such Information is the property and/or confidential information of Legal & General and may not be disclosed by you to any other person without the prior written consent of Legal & General.No party shall have any right of action against Legal & General inn relation to the accuracy or completeness of the Information, or any other written or oral information made available in connection with publication. Any investment advice that we provide to you is based solely on the limited initial information which you have provided to us. No part of this or any other document or presentation provided by us shall be deemed to constitute ‘proper advice' for the purposes of the Pensions Act 1995 (as amended). Any limited initial advice given relating to professional services will be further discussed and negotiated in order to agree formal investment guidelines which will form part of written contractual terms between the parties.Past performance is no guarantee of future results. The value of an investment and any income taken from it is not guaranteed and can go down as well as up, you may not get back the amount you originally invested. The Information has been produced for use by a professional investor and their advisors only. It should not be distributed without our permission. The risks associated with each fund or investment strategy are set out in this publication, the relevant prospectus or investment management agreement (as applicable) and these should be read and understood before making any investment decisions. A copy of the relevant documentation can be obtained from your Client Relationship Manager.

Confidentiality and limitations:

Unless otherwise agreed by Legal & General in writing, the Information in this document (a) is for information purposes only and we are not soliciting any action based on it, and (b) is not a recommendation to buy or sell securities or pursue a particular investment strategy; and (c) is not investment, legal, regulatory or tax advice. Any trading or investment decisions taken by you should be based on your own analysis and judgment (and/or that of your professional advisors) and not in reliance on us or the Information. To the fullest extent permitted by law, we exclude all representations, warranties, conditions, undertakings and all other terms of any kind, implied by statute or common law, with respect to the Information including (without limitation) any representations as to the quality, suitability, accuracy or completeness of the Information.Any projections, estimates or forecasts included in the Information (a) shall not constitute a guarantee of future events, (b) may not consider or reflect all possible future events or conditions relevant to you (for example, market disruption events); and (c) may be based on assumptions or simplifications that may not be relevant to you. The Information is provided ‘as is' and 'as available'. To the fullest extent permitted by law, Legal & General accepts no liability to you or any other recipient of the Information for any loss, damage or cost arising from, or in connection with, any use or reliance on the Information. Without limiting the generality of the foregoing, Legal & General does not accept any liability for any

indirect, special or consequential loss howsoever caused and on any theory or liability, whether in contract or tort (including negligence) or otherwise, even if Legal & General has been advised of the possibility of such loss.

Third party data:

Where this document contains third party data ('Third Party Data'), we cannot guarantee the accuracy, completeness or reliability of such Third Party Data and accept no responsibility or liability whatsoever in respect of such Third Party Data.

Publication, amendments and updates:

We are under no obligation to update or amend the Information or correct any errors in the Information following the date it was delivered to you. Legal & General reserves the right to update this document and/or the Information at any time and without notice. Although the Information contained in this document is believed to be correct as at the time of printing or publication, no assurance can be given to you that this document is complete or accurate in the light of information that may become available after its publication. The Information may not take into account any relevant events, facts or conditions that have occurred after the publication or printing of this document.

Telephone recording:

As required under applicable laws Legal & General will record all telephone and electronic communications and conversations with you that result or may result in the undertaking of transactions in financial instruments on your behalf. Such records will be kept for a period of five years (or up to seven years upon request from the Financial Conduct Authority (or such successor from time to time) and will be provided to you upon request.

Legal & General Investment Management Limited. Registered in England and Wales No. 02091894. Registered Office: One Coleman Street, London, EC2R 5AA. Authorised and regulated by the Financial Conduct Authority, No.

119272.

Legal and General Assurance (Pensions Management) Limited. Registered in England and Wales No. 01006112. Registered Office: One Coleman Street, London, EC2R 5AA. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority, No. 202202.

LGIM Real Assets (Operator) Limited. Registered in England and Wales, No. 05522016. Registered Office: One Coleman Street, London, EC2R 5AA. Authorised and regulated by the Financial Conduct Authority, No. 447041. Please note that while LGIM Real Assets (Operator) Limited is regulated by the Financial Conduct Authority, we may conduct certain activities that are unregulated.

Legal & General (Unit Trust Managers) Limited. Registered in England and Wales No. 01009418. Registered Office: One Coleman Street, London, EC2R 5AA.Authorised and regulated by the Financial Conduct Authority, No.

119273.

This post is funded by LGIM