The agricultural sector has a central role to play in helping to solve many of the problems currently facing our society from sufficient and healthy food production, to biodiversity loss and global warming.

In contrast, regenerative farming helps restore nature by taking advantage of the natural tendencies of ecosystems to regenerate when disturbed. This is not philanthropy, where returns are secondary. Investing in regenerative farms and practices is a long term real asset activity, where financial returns and sustainable returns go hand in hand.

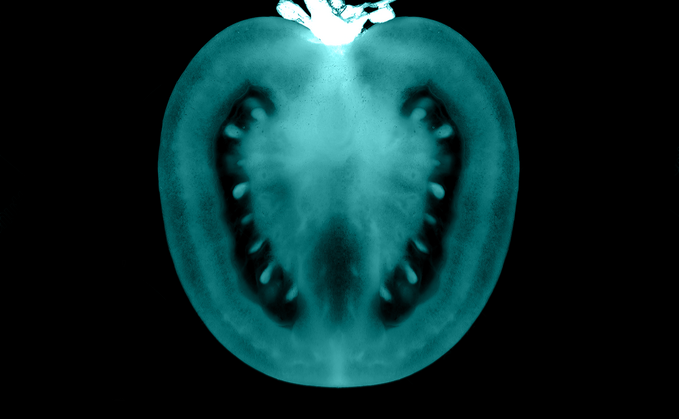

Watch the video to learn more

Do you want to know more? Visit our website to read more about Regenerative farming and to download our whitepaper Unlock the potential of Natural Capital.

General risks to take into account when investing in Farmland

Please note that all investments are subject to market fluctuations. Investing in agricultural land has an average risk. These categories are generally characterised by stable income and relatively stable collateral. On the other hand, the tradability can be limited.

Disclaimer

This is a marketing message for professional investors.

Van Lanschot Kempen Investment Management NV is authorised as a management company and regulated by the Dutch Authority for the Financial Markets (AFM). The Fund is registered under the license of Van Lanschot Kempen Investment Management NV at the Dutch Authority for the Financial Markets (AFM). The Fund is notified for offering in a limited number of countries. The countries where the Fund is notified can be found on the website. The Fund is only available for professional investors.

The information in this document provides insufficient information for an investment decision.

Please read the the prospectus (available in English) and the sustainability-related disclosures before making an investment decision. These documents of the Fund are available on the website of VLK (vanlanschotkempen.com/en-nl/investment-management/fund-library) The information on the website is (partly) available in Dutch and English. Here you can also find our sustainability-related disclosures.

Capital at risk

The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested. Past performance provides no guarantee for the future.