After several decades of ever closer interconnectedness between the world's economies, our research suggests that we are entering a new, more volatile regime, with greater divergence between countries. This pullback from globalisation is often viewed through a negative lens, but from an asset allocator's perspective, we think a more nuanced approach is appropriate. Below we explore the macro picture driving this greater dispersion between economies and set out some of the key implications for portfolios.

Understanding the divergent macro picture

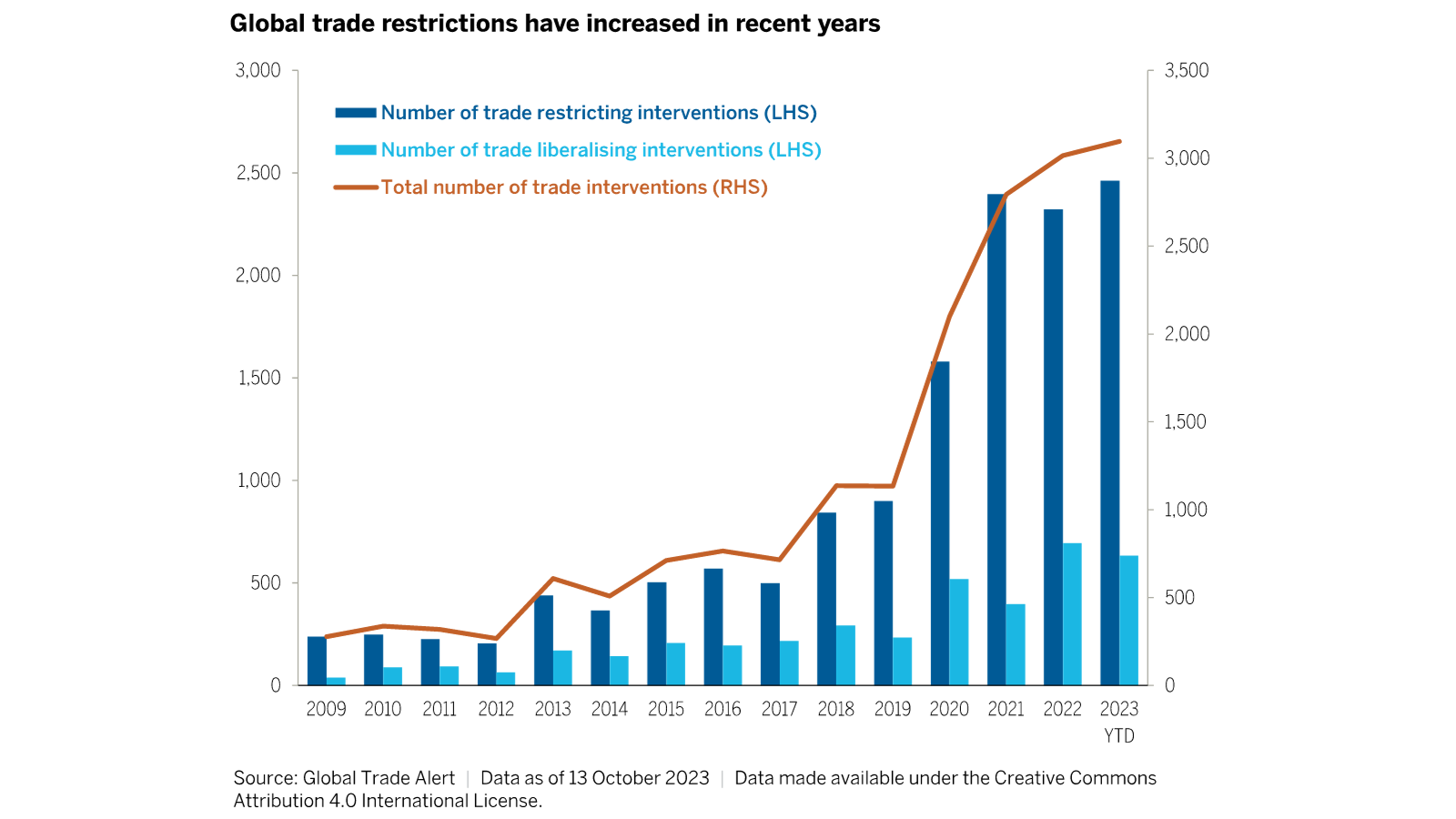

From a macro perspective, this new regime involves structurally higher inflation, shorter and more volatile cycles, reduced availability of labour and fractured global supply lines, all intensified by increased geopolitical rivalry and climate change. And while globalisation reduced income inequality across countries, it greatly increased it within countries. Now, the consensus around an increasingly globalised world is openly being called into question. Governments have started to pursue policies that support domestic demand and industry in critical areas such as energy transition and technology in a context of rapidly increasing trade restrictions (Figure 1), further accelerating divergence. Central banks are also likely to diverge in line with shifting domestic cycles and government policies.

Figure 1:

An unchanging market narrative

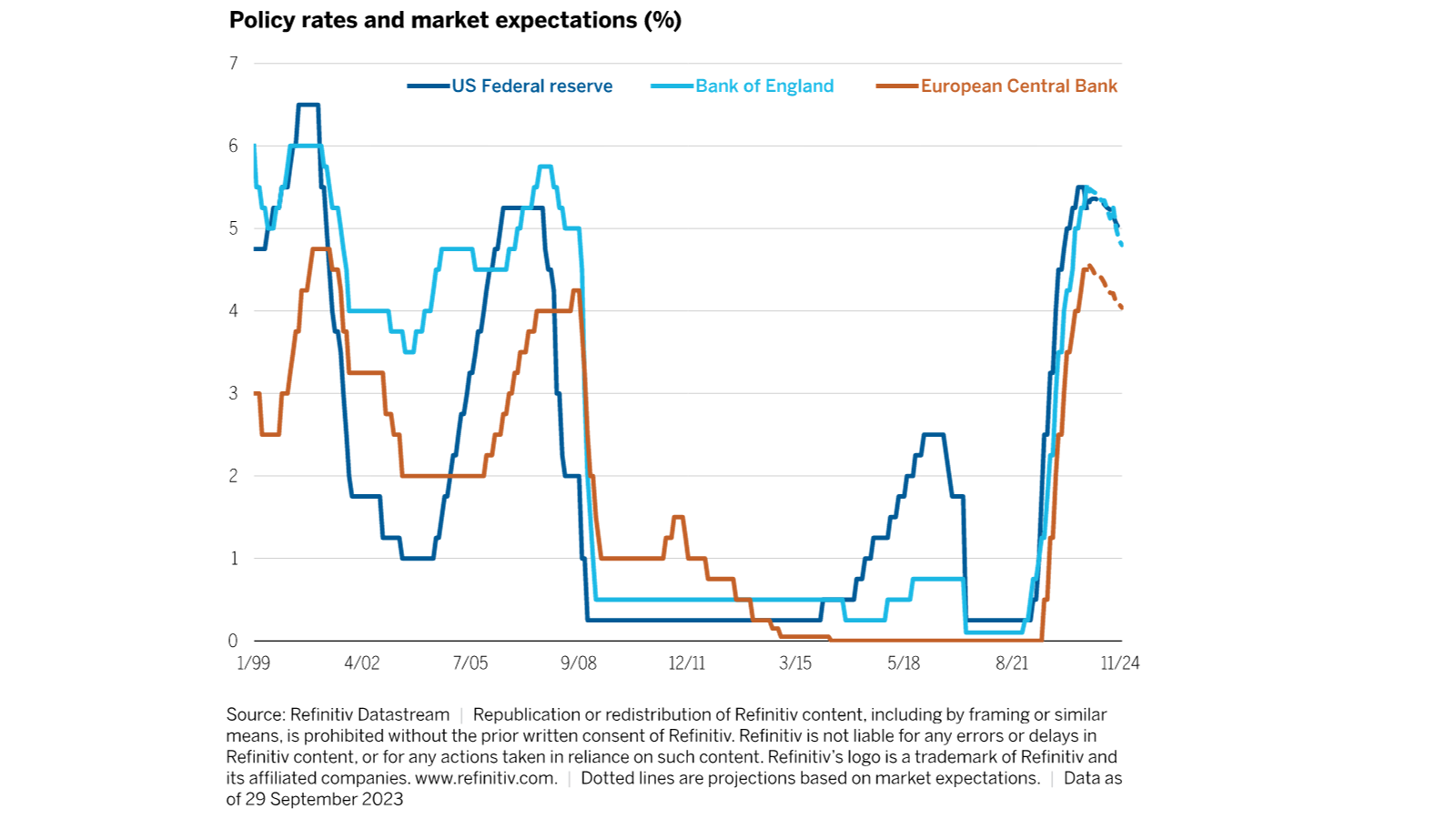

Despite the above, markets continue to price for economic convergence and central banks staying in a tight pack, led by the US Federal Reserve (Fed). The market's expectation (Figure 2) appears to be that the Fed will continue to lead the hiking and subsequent cutting cycle, with other central banks, to varying degrees, following suit, albeit with a lag, while the Bank of Japan stays on hold. That's been the pattern since 1998 and the market currently appears to believe it will always be thus.

Figure 2 :

Three factors may help to explain this continued belief in Fed-led policy convergence:

· Lack of "independent" thinking — with central banks all applying similar prescriptions. While there may be some truth in this view, we think this consensus may fray as economies face differing levels of inflation.

· Capital flows — Increased globalisation meant that if a country's monetary policy moved too far away from the Fed's, its currency appreciated, which, in effect, taxed growth.

· US-led global growth — Since the late 1990s, the world has, essentially, "lived off" US consumer spending. Put simply, countries such as China, Germany and Japan have accumulated huge pools of savings by providing the world with consumer and capital goods. This has allowed the funding of persistent current account deficits in the US (and the UK). With the US cycle so crucial to the rest of the world, it was only natural for other central banks to follow the Fed.

A return to dispersion

Prior to the late 1990s and particularly during the 1970s and 1980s, other countries had their own domestic demand cycles, with substantial variation in growth (real and nominal) between countries and no significant outliers in real and nominal consumer spending. At times, fiscal and monetary policies also moved in very different directions and by some margin.

While well-established paradigms take time to shift, our work points to a high chance that we are moving back to this previous environment. Key developments to note in this context are:

· The deliberate policy decisions in Europe and Japan to distribute more income and savings from companies and the government to households. From COVID to the cost-of-living crisis, the downside for households has been largely absorbed by governments. As a result, there are clear signs that domestic demand is being boosted in both regions. The second-order impact of reducing current account surpluses is that current account deficits elsewhere will become a lot more expensive to finance.

· The accumulated savings rate in China may be of a more structural nature given the limited social safety net. Nevertheless, we expect stronger domestic consumption to become an important driver of future growth.

Already, the services sector rather than manufacturing is leading growth in each of these regions, and if, as we believe, the domestic demand stories take hold, the interlinkages between different economies and market pricing will change, with major implications for long-term rates and a range of assets.

Asset allocation implications

From an asset allocation perspective, higher volatility and dispersion between regions has multiple implications, and counterintuitively, these are not all negative. Volatility creates higher risk but also opportunity, hence asset allocators need to think carefully about how they adapt their portfolio approach.

On the positive side of the balance sheet, a divergent regime provides:

· A wider opportunity set — across phases of the cycle as economies increasingly move through their cycles at different paces, with countries having more control over the impact of their fiscal and monetary policies. From a systemic perspective, this reduces the probability that the global economy is one "US accident" away from a global recession or crisis.

· Greater potential for portfolio resilience — Even if volatility is higher, more dispersion between regions and a growing reliance on domestic drivers may increase the potential for asset allocators to enhance portfolio resilience and reduce overall risk given the likely beneficial impact of decorrelation.

On the negative side, reduced correlations come at a price:

· Higher volatility —More pronounced and diverging cycles will lead to greater volatility and more unpredictability in asset prices.

· Lower productivity — Deglobalisation will erode productivity gains resulting from lower trade barriers and global supply chain efficiencies and may translate into lower economic growth, higher inflation and, ultimately, lower asset returns.

· Debt sustainability — The massive transfers made by governments to support their citizens in recent years are raising questions about debt sustainability, particularly as the path to fiscal consolidation is harder to envisage given the current tendency towards polarised and populist politics. In combination with reduced global trade flows, these higher fiscal deficits may contribute to higher and stickier inflation but also to a rise in term premia — as investors require higher compensation for the risk taken, which, in turn, could put pressure on the valuations of a wide range of assets in both public and private markets.

To prosper in this new regime, we think investors need be highly deliberate and systematic in their portfolio construction, with the above risks and opportunities in mind. This includes thinking about:

· Factor and beta exposures in a systematic way;

· Optimum use of active research-led approaches at both a security and thematic level;

· Increased geographic diversification across developed and emerging markets while keeping a very close eye on emerging country-specific risks;

· Currency hedging as higher currency volatility may strengthen the case for currency risk hedging in portfolios; and

· Higher allocations to alternatives to provide further diversification and help shield portfolios from volatility by providing potentially uncorrelated returns.

In summary

Based on our research, we believe we are returning to a world of macroeconomic divergence. Investors should prepare for that eventuality and use the above considerations to help adjust their asset allocation.

Contact team | Wellington UK Institutional

Disclaimer

For professional, institutional and accredited investors only. Capital at risk. The views expressed are those of the authors and are subject to change. Other teams may hold different views and make different investment decisions. This material and its contents are current at the time of writing and may not be reproduced or distributed in whole or in part, for any purpose, without the express written consent of Wellington Management. While any third-party data used is considered reliable, its accuracy is not guaranteed. This commentary is provided for informational purposes only and should not be viewed as a current or past recommendation and is not intended to constitute investment advice or an offer to sell or the solicitation of an offer to purchase shares or other securities. Holdings vary and there is no guarantee that a portfolio has held or will continue hold any of the securities listed. Wellington assumes no duty to update any information in this material in the event that such information changes.

In the UK, issued Wellington Management International Limited (WMIL), a firm authorised and regulated by the Financial Conduct Authority (Reference number: 208573[EC3] ). In Europe (ex. UK and Switzerland), issued by Wellington Management Europe GmbH which is authorised and regulated by the German Federal Financial Supervisory Authority (BaFin).

©2023 Wellington Management. All rights reserved. As of 01 January 2023.