Introduction

In part 1 of our DC buyers' guide, we discussed the need to consider structure, scale and diversification when selecting a private markets investment fund. Here, we move on to price, explaining how, by investing in high quality funds that incorporate value-added services, it may be possible to enhance the potential return on your investment.

Quality and expertise

A new approach to building a private markets fund allows DC investors to access a diverse variety of assets within a single vehicle. These assets include private credit, private equity, infrastructure, real estate, and natural resources. However, when assessing a private markets solution, investors should evaluate not just the asset class mix, but the quality of the underlying components used to implement it.

Our key challenge as portfolio managers is balancing high-quality investment teams with cost efficiency. Private markets reward top-tier managers, so we prioritise Master Fund – the flagship vehicles that ensure superior quality. While cheaper alternatives reduce fees, they often compromise expertise and diversification, making them a false economy that can harm returns.

Fund proposition

Beyond simply selecting high-quality funds, we believe investors should consider the fund proposition type. We define these as Core, Core Plus or Opportunistic, as described below.

Figure 1. Definitions of our classification of funds

For example, Core Plus funds may initially appear costly relative to Core funds, however we believe that they could deliver superior value. Investors may pay a modest premium to gain access to expertly managed, diversified investments that have a wider toolkit available to augment returns. For example, managers can selectively use leverage (borrowing) to provide more than £1 of exposure for each £1 invested. This can reduce the cost of the total investment below the headline figure, making Core Plus an efficient and effective way to optimise returns. This value-add is illustrated in the following example:

Fund A is a £100,000 investment in an infrastructure fund that focuses on projects such as bridges, roads and energy facilities and charges a fee of 0.85% or £850 pa. The Net Asset Value (NAV) of their investment is £100,000.

The fund invests this £100,000 into underlying assets, but supplements this with additional borrowing, resulting in an aggregate investment of £166,670. This results in a leverage ratio (debt to total assets) of 1.4x, a relatively typical level for a fund of this type. This expands the amount of exposure that the investor has to the asset class, giving them a Gross Asset Value (GAV) of £166,670.

While the underlying fee the investor has paid remains the same, it's spread over a large asset base. The economic value gained via the leverage exposure cuts the cost to a theoretical 51bps.

It's important to note that leverage is applied in a carefully controlled and risk-managed manner to enhance investment potential. We complete due-diligence and select expert managers who conduct thorough analysis to ensure risks are carefully monitored. This disciplined approach ensures that leverage is used effectively, contributing to long-term investment growth potential without unnecessary exposure to risk.

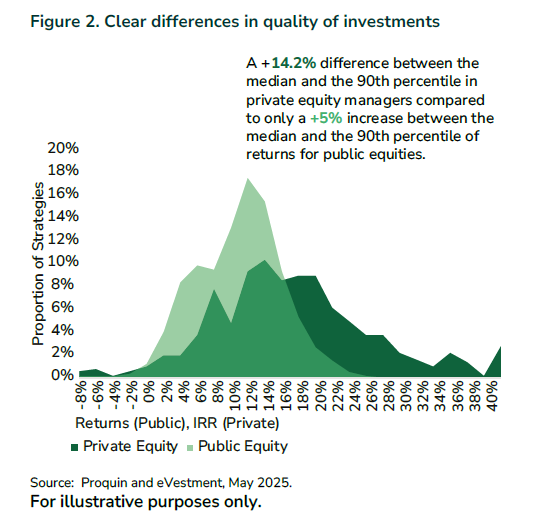

In addition to leverage, selecting high-quality underlying managers is essential when considering expected returns in the construction of a private market fund-of-funds strategy. Across asset classes, choosing top-tier managers – rather than simply opting for the lowest-cost options – plays a critical role in aiming to drive performance. This is particularly important in private markets .

This is illustrated by private equity in Figure 2, with a 14.2% gap between the median and the 90th percentile, versus only a 5% difference in public equity. The wider variability in outcomes makes manager selection an even more crucial consideration in private market investments to enhance overall portfolio returns.

Conclusion

When evaluating investment costs, it's clear they are not always as straightforward as they initially seem. As such, we believe it is essential to look beyond headline fees and understand the true value.. A fund's structure, market exposure, manager expertise, and diversification all play a crucial role in determining its overall worth. Simply put – not all fees are created equal.

We believe ensuring investors gain access to leading managers and flagship funds without compromising on quality is key. With a focus on Core Plus investments, investors could benefit from quality diversified exposure through a long-term approach that also prioritises strong governance, manager selection, asset allocation, and robust liquidity management.

Furthermore, thanks to our scale at L&G, we aim to offer attractive fees for quality investments, therefore delivering cost- efficiency without sacrificing value.

Authors:

Martin Dietz, Head of Diversified Strategies, L&G and Jayesh Patel, Head of UK DC Distribution, L&G

Key risks

The above information does not constitute as advice.

The value of an investment and any income taken from it is not guaranteed and can go down as well as up, and the investor may get back less than the original amount invested. Past performance is not a guide to future performance.

It should be noted that diversification is no guarantee against a loss in a declining market.

Risk management cannot fully eliminate the risk of investment loss.

Reference to a particular security is on a historic basis and does not mean that the security is currently held or will be held within an L&G portfolio. The above information does not constitute a recommendation to buy or sell any security.

Tax treatment is based on individual circumstances and is subject to change.

The risks associated with each fund or investment strategy should be read and understood before making any investment decisions. Further information on the risks of investing is available from L&G's Fund Centres.

Important information

The information in this document is for professional investors and their advisers only. This document is for information purposes only and we are not soliciting any action based on it. The information in this document is not an offer or recommendation to buy or sell securities or pursue a particular investment strategy and it does not constitute investment, legal or tax advice. Any investment decisions taken by you should be based on your own analysis and judgment (and/or that of your professional advisers) and not in reliance on us or the Information.

This document does not explain all of the risks involved in investing in the fund or investment strategy. No decision to invest in the fund or investment strategy should be made without first reviewing the prospectus, key investor information document and latest report and accounts for the fund, which can be obtained from L&G's Fund Centres..

This document has been prepared by Legal & General Investment Management Limited and/or their affiliates ('L&G', ‘we' or ‘us'). The information in this document is the property and/or confidential information of Legal & General and may not be reproduced in whole or in part or distributed or disclosed by you to any other person without the prior written consent of L&G. Not for distribution to any person resident in any jurisdiction where such distribution would be contrary to local law or regulation.

No party shall have any right of action against L&G in relation to the accuracy or completeness of the information in this document. The information and views expressed in this document are believed to be accurate and complete as at the date of publication, but they should not be relied upon and may be subject to change without notice. We are under no obligation to update or amend the information in this document. Where this document contains third party data, we cannot guarantee the accuracy, completeness or reliability of such data and we accept no responsibility or liability whatsoever in respect of such data.

This financial promotion is issued by Legal & General Investment Management Limited.

Legal and General Assurance (Pensions Management) Limited. Registered in England and Wales No. 01006112. Registered Office: One Coleman Street, London, EC2R 5AA. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority, No. 202202.

LGIM Real Assets (Operator) Limited. Registered in England and Wales, No. 05522016. Registered Office: One Coleman Street, London, EC2R 5AA. Authorised and regulated by the Financial Conduct Authority, No. 447041. Please note that while LGIM Real Assets (Operator) Limited is regulated by the Financial Conduct Authority, it may conduct certain activities that are unregulated.

Legal & General (Unit Trust Managers) Limited. Registered in England and Wales No. 01009418. Registered Office: One Coleman Street, London, EC2R 5AA. Authorised and regulated by the Financial Conduct Authority, No. 119273.

© 2025 Legal & General Investment Management Limited, authorised and regulated by the Financial Conduct Authority, No. 119272.

Registered in England and Wales No. 02091894 with registered office at One Coleman Street, London, EC2R 5AA.