Tariffs remain a central force in shaping global trade dynamics. While often implemented to protect domestic industries, they can disrupt supply chains, alter trade flows, and create inefficiencies. For institutional investors, these disruptions present both risks and opportunities. A well-structured trade finance strategy can offer resilience and adaptability in navigating this evolving landscape.

Federated Hermes has been active in trade finance since 2007, offering access to short-term, self-liquidating loans that facilitate cross-border transactions. These instruments are typically secured by the underlying goods and priced at a spread over short-duration benchmarks such as the Secured Overnight Financing Rate (SOFR). This structure provides low interest rate and credit duration exposure, making it particularly suitable for volatile environments.

Risk mitigation is embedded in the investment process through mechanisms such as permanent control of goods' titles, ring-fenced cash flows, and bespoke insurance arrangements. Each transaction is tailored to the specific trade route, commodity type, and counterparty credit profile, ensuring a high degree of control and transparency.

Trade Flow Dynamics: North-North vs. South-South

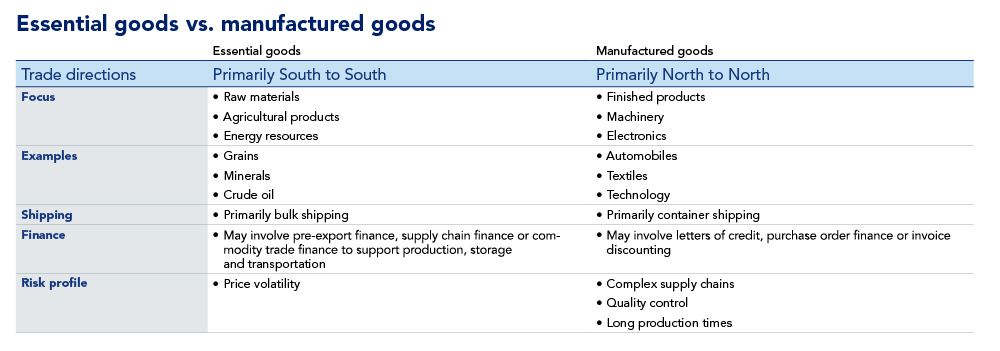

Understanding trade flows is fundamental to constructing a resilient trade finance portfolio. Broadly, global trade can be segmented into:

- North-North trade: Involves high-income economies such as the US, Canada, the EU, Japan, and South Korea. These routes are dominated by manufactured goods—electronics, vehicles, and machinery—often shipped via containers.

- South-South trade: Connects developing economies including Brazil, India, China, and South Africa. These flows are concentrated in essential goods—food, fuel, and medicine—often shipped in bulk and critical to domestic consumption and social stability.

According to UN Conference on Trade and Development (UNCTAD), between 2020 and 2022, 66% of developing countries and 80% of least developed countries remained commodity-dependent, with over 60% of their merchandise exports derived from primary goods. Essential goods are generally shielded from high tariffs to preserve affordability and avoid economic disruption. In contrast, manufactured goods, being less critical to immediate survival, are more likely to face higher tariffs aimed at protecting domestic industries or adjusting trade balances.

Strategic Allocation: Aligning with Trade Shifts

The last 25 years have seen a notable shift. Developed economies' share of global trade has declined by almost 15%, while South-South trade has grown by 14.1%, according to UNCTAD. While North-North trade still accounts for 37.1% of global flows, South-South trade now accounts for 25%— a sign of changing global dynamics.

Federated Hermes has strategically aligned its portfolio with these trends. As of March 31, 2025, 51% of the Strategy's notional value is allocated to South-South trade, with a strong emphasis on essential goods. A further 42% is allocated to North-South trade (excluding the US), helping mitigate exposure to US-centric tariff risks and enhancing resilience against geopolitical disruptions.

Supply Chain Strategy: Responding to Geopolitical Realignment

The reconfiguration of global supply chains is accelerating in response to geopolitical tensions, regulatory shifts, and tariff regimes. Corporates are increasingly adopting alternative sourcing models:

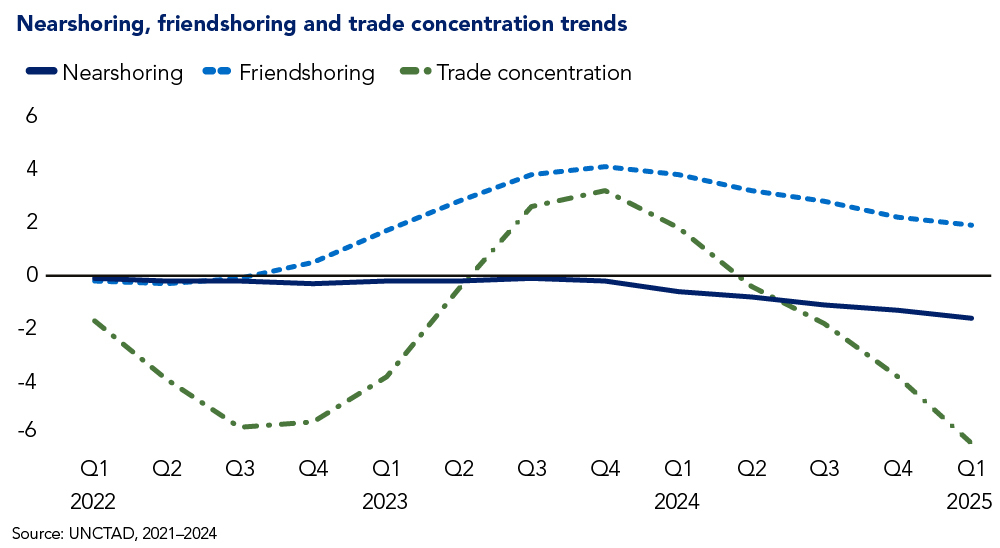

- Nearshoring: focuses on relocating production or sourcing closer to the company's home country, reducing shipping times and costs while improving supply chain resilience.

- Friendshoring: involves relocating production and sourcing to countries that share similar political and economic values, aiming to reduce geopolitical risks by partnering with trusted allies.

- Allyshoring: is similar to friendshoring and emphasises reliance on countries with strong diplomatic ties, focusing on building supply chains with strategic allies to enhance security and stability.

UNCTAD data shows that friendshoring and trade concentration peaked in 2023 but began tapering in 2024. While activity remains above pre-pandemic levels, the decline suggests a shift away from trade among geopolitically aligned nations. The introduction of new tariffs is likely to accelerate this trend, prompting further diversification of sourcing strategies.

Federated Hermes is well-positioned to capitalise on these developments. The Strategy's emphasis on short-duration, low-interest investments allows for rapid reallocation in response to changing trade routes and supply chain configurations.

Resilience Through Diversification and Agility

Over the last five years, international trade supply chains have undergone significant transformations due to geopolitical tensions, technological advancements and changing consumer expectations. These forces are driving a broader transformation toward supply chains that are more resilient, transparent and sustainable.

The Federated Hermes Trade Finance Strategy has continued to demonstrate strong resilience amid tariff fluctuations. By prioritising trade loans tied to essential goods that may be less susceptible to tariffs—and maintaining a diversified approach across not only trade directions but supply chain structures as well, we believe we have sheltered the majority of our portfolio from high tariffs.

The remaining is concentrated in sectors with the flexibility to pivot sourcing strategies if needed, potentially ensuring minimal disruption. By staying agile and forward-looking, we continue to navigate the complexities of global trade with confidence—seeking to deliver uncorrelated returns and opportunity for our clients in an unpredictable world.

For professional investors only. Capital at risk.

The value of investments and income from them may go down as well as up, and you may not get back the original amount invested. The views and opinions contained herein are those of the author and may not necessarily represent views expressed or reflected in other communications. This does not constitute a solicitation or offer to any person to buy or sell any related securities or financial instruments.

Issued and approved by Hermes Investment Management Limited ("HIML") , as distributor, which is authorised and regulated by the Financial Conduct Authority. Registered address: Sixth Floor, 150 Cheapside, London EC2V 6ET.