Historically, investors outside of China have struggled to access the country's full range of unique investment opportunities. But this story is changing as policymakers seek to liberalize Chinese stock and bond markets to allow greater access to onshore Chinese investments.

At $17.5t trillion in assets, China is the second largest bond market in the world and offers unique and distinct portfolio attributes. [Source: Source: WIND, as of December 2020.] Although various reforms such as the introduction of Bond Connect, have simplified access to the onshore Chinese bond markets, supporting over $500bn of foreign capital into the market - more than half of which has been gathered since 2019, [Source: Bloomberg and JP Morgan index inclusion have completed as of end 2020, with FTSE WGBI inclusion planned to commence in October 2021. Estimated inflows from three indices respectively are US$150bn, US$30bn and US$150bn respectively.] foreign investment stands at only 3%. As Chinese markets continue to open, market participants expect increasing levels of foreign investment, benchmark inclusion, and tradability. Institutional portfolios need to consider the impact this evolution will have on their portfolio profile, returns and tracking implications.

Given the attractive portfolio attributes that the market offers, coupled with China's focus on the quality of its economic growth trajectory, Pension schemes should consider how China bond allocations can support their long-term funding and diversification needs as they head into the next decade.

A unique opportunity?

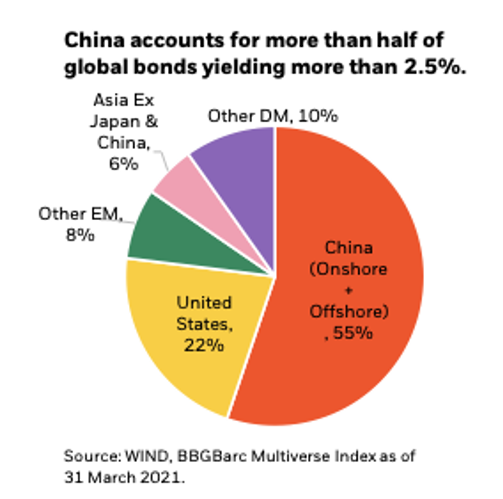

China bond total returns provide attractive diversification benefits given their low correlation to other developed market bonds. When bond markets around the world were rocked by the beginning of the Covid-19 pandemic, China bonds were relatively flat. The asset class also offers higher yields than developed market debt, a topic of significant importance given the global yield scarcity that has existed for many years. Today, half of all bonds that yield 2.5% or more - both government and credit - are in China.

FTSE World Government Bond Index (WGBI) inclusion confirms China's arrival on global bond stage

In March 2021, FTSE Russell announced that Chinese government bonds will be included in its flagship FTSE World Government Bond Index (WGBI) and its derived indexes. The inclusion is to occur over a period of 36 months commencing with an effective date of 29 October 2021 (thus spanning from Nov. 2021 to Oct. 2024). The projected weight of China in the WGBI index is roughly 5.71% based on August 2021 index profile. This confirmation is based on affirmation with members of the FTSE Russell advisory committees and other index users that ongoing reforms to the Chinese government bond market warrant inclusion in the WGBI.

Since its September 2020 Fixed Income Country Classification Results Announcement, FTSE Russell has engaged closely with Chinese authorities and market stakeholders to monitor previously implemented market enhancements and recent reforms to facilitate easier participation by international investors. These include simplification of the account opening process, the option to transact foreign exchange with third parties and the freedom to lengthen the settlement cycle beyond T+3.

Zhanying Li, Senior director, head of Data & Analytics product sales, APAC, FTSE Russell: "Foreign ownership of Chinese governments continues its upward trend, it is over 11% by end of July 2021. In fact, the net inflow into Chinese government bond market by foreign investors for the first seven month of 2021 is a stunning 81% of total net issuance during the same period."

For more information about the inclusion of China Bonds into FTSE WGBI, please download our research here

ETFs play a crucial role in providing China bond access

Many bond portfolios remain heavily underweight to China, with average allocations at just 0.05%. [Source: Portfolio average allocation figures based on BPAS EMEA client portfolios gathered between 31 Dec 2019 and 31 Dec 2020.] This active underweight could have material and unintended implications for yield, returns and tracking, and Pension schemes are increasingly having to focus on what this means for their portfolio.

While Chinese markets are opening to foreign investors, the operational complexities of setting up direct trading and access has proven to be a time consuming and resource intensive process. Pension schemes in the UK are discovering that the time and resource commitment to achieve local onshore trade and settlement is high. European domiciled and European listed ETFs that trade in local time zones provide investors with a significantly more simplified access route to gain the desired exposure. Asset managers with global scale and local expertise who can deliver product and trading efficiency are playing a key role for investment industry.

iShares' China Bond ETF suite has experienced an accelerated rate of adoption, with aggregate assets surpassing $13bn since the first funds were launched in 2019. Secondary market trading and liquidity has also improved significantly. The ability to trade in size, at low cost, and in real-time, has driven the growth and adoption of China bond ETFs for efficient market access. [Source: BlackRock, as of 31/08/21]

In summary - a market that cannot be ignored.

Though the numbers remain small compared to the size of the country's market, China bonds are a growing component of global bond indices - investors won't be able to ignore them for much longer. Diversification and yield benefits are particularly attractive, and while geo-political risks exist, this growing and increasingly high-quality market is an allocation that we believe institutional investors will be focusing more on in the future.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or financial product or to adopt any investment strategy.

You can contact Justin Wheeler at the following

Risk Warnings

Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy.

Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially. Levels and basis of taxation may change from time to time.

Important Information

This material is for distribution to Professional Clients (as defined by the Financial Conduct Authority or MiFID Rules) only and should not be relied upon by any other persons.

In the UK and Non-European Economic Area (EEA) countries: this is Issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: + 44 (0)20 7743 3000. Registered in England and Wales No. 02020394. For your protection telephone calls are usually recorded. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock.

Any research in this document has been procured and may have been acted on by BlackRock for its own purpose. The results of such research are being made available only incidentally. The views expressed do not constitute investment or any other advice and are subject to change. They do not necessarily reflect the views of any company in the BlackRock Group or any part thereof and no assurances are made as to their accuracy.

This document is for information purposes only and does not constitute an offer or invitation to anyone to invest in any BlackRock funds and has not been prepared in connection with any such offer.

© 2021 BlackRock, Inc. All Rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, iSHARES, BUILD ON BLACKROCK and SO WHAT DO I DO WITH MY MONEY are trademarks of BlackRock, Inc. or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners.