Nest corporation

Law and Regulation

Nest chief executive says tweaking the PSB could turn it into an ‘engine for investment’

Industry

Annual report shows 9.9% five-year returns for 2045 growth phase fund

Industry

Government-backed master trust AUM grew to more than £40bn as at 31 March 2024

Appointments

PP brings together all the appointments in the pensions industry over the past week

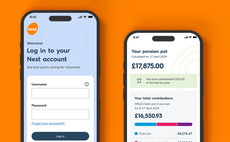

Admin / Technology

‘Nest Pensions’ will initially be available on iOS devices and will allow for pension transfers

Defined Contribution

Amendments will cover death benefits and deductions from member accounts

Industry

Professional Pensions rounds up some of the latest tender awards from across the industry.

Industry

Nest Insight and the Department for Work and Pensions (DWP) are set to conduct research to examine the financial impact of Covid-19 on self-employed people.

Defined Contribution

Nest saw average inflows of £400m in new contributions per month over the course of 2019/20, leading to a 67% increase in assets under management (AUM).

Industry

Millions of people are saving for a pension for the first time thanks to AE, but the Covid-19 crisis has posed a communications challenge. James Phillips looks at how to get the long-term nature of pensions across to this new generation of savers.